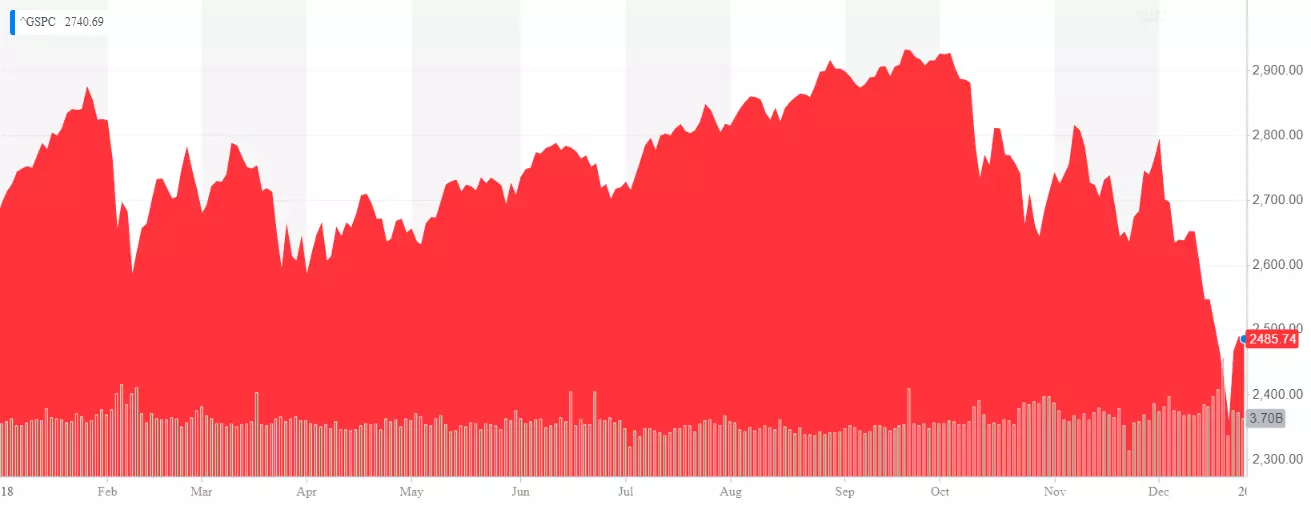

Well… The worst December since the Great Depression is almost finished. The month itself was not bad, actually. I had a great time, taking into account that I’m enjoying a somewhat long vacation and using the full potential of my time. But from a stock investor’s perspective – yes, it was a pretty bad December. I’ll let the picture below convey what might have been thousand words.

Although the biggest, it was the easiest significant loss to handle. Basically, the only money I have invested in the stock market, or anything else, are those that I don’t and won’t need. I have a really high cash allocation, initially planned for a down-payment but we’ll see, and everything that I’ve invested is using money I really don’t need.

Another reason I’m handling the December’s plunge with ease is because I have faith in the US (and thus the world’s) economy. I think that if the “empire” falls, we’ll have much bigger problems than the losses in our portfolios. And this goes for both people living in the USA and outside, such as myself.

And on top of that, even if it is a “falling knife”, I’d be completely fine with it. I won’t corrupt my strategy, which means I’ll just continue contributing to my portfolio on the way down. Maybe I’d be different if I had a larger holding in stocks, but having a strong emergency fund, as pointed out later in this post, makes me pretty calm in regards to the current market trend.

The economy is cyclical. It may take a while, but I’d be more than happy to wait it out. At the end, catching the next bull run early in your investing journey is a blessing! And the only thing that that can happen is with a bear market and/or a recession.

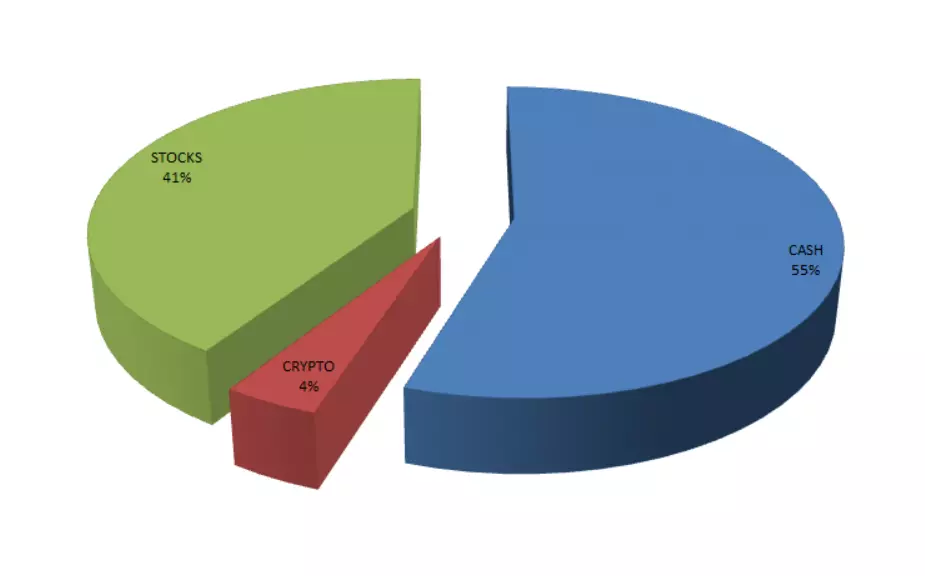

December Asset Allocation

Not much to say apart from the obvious. The stocks went downhill, the cash is stable, and the crypto I bought using the frowned upon strategy called market timing went up more than 60%. It’s a good feeling, but that’s about it. Since I was pretty conservative with the amounts I used to buy cryptocurrency, I’ll just hodl for now.

We also had a potential dead cat bounce in the S&P 500 towards the end of the month, which was right when I bought. I don’t want to make my financial updates look like a financial news post, so I’ll leave it at that.

December FIRE Progress

Well, if it was under my control, it would’ve gone higher. However, it went from 27,75% to 28,32%.

Talking about control, I have a couple of ideas that I’ll start realizing after I’m back from my vacation. I want to increase my side-income by being more involved in fields I have interest in, but I’ll talk about them in more detail in other specific posts. The idea is not to earn as much as possible, but to work on something more enjoyable and in line with my personality. At the end of the day, the point of being FI is to make the money an irrelevant factor when it comes to undertaking ventures.

But let’s talk about it more in a week or two. 🙂

Subscribe below and get the weekly updates, so you don’t miss a post.

Lastly, happy new year and lots of $uccess & happiness in the next 360+ days!

One comment