Limiting Exposure – Risk Tolerance, Asset Allocation, Diversification (January 2020)

There were numerous cases where end of month was nearing and I had virtually no idea what to write about on the monthly update.

In those months, I used the plan B – falling back to sharing my asset allocation (like it requires continuous updating) and my percentage to FIRE (like it adds any value to anyone). I criticized the concept of arbitrary financial updates in a separate post and ultimately stopped doing it.

However, this month was absolutely not one of those in which I don’t have anything to report.

From losses and shadiness in the P2P market to gains and all time highs in the stock and crypto markets, it had it all.

So let’s dive in.

Kuetzal and Envestio

I think most of my readers are already aware of the recent activities surrounding these platforms.

It all started with detecting suspicious activities from Kuetzal, such as lending money to a company that doesn’t exist, through investor panic and media silence, all the way to exposing “real” projects as being from a company founded by the former CEO’s wife. Although without proof of scams and seemingly legit up to that point, early withdrawals and alleged directed attacks caused Envestio to shut down operations as well. Both these platforms’ websites are now down and there are legal proceeds for recovering funds and seeking justice.

What a summary.

Whatever I cover here will be less inclusive than what other P2P oriented bloggers did throughout the month, so check out these posts if you’d like to read more:

- Is Kuetzal a Scam? by FinanceFreedom – a great summary of the highlights around the Kuetzal case

- Is Envestio a Scam? by FinanceFreedom – another comprehensive summary highlighting the events around Envestio

- Concerns about Kuetzal by FinanciallyFree – a post that was continuously updated as events unfolded, caused lots of discussion and creation of the first Telegram group for scammed investors (details inside)

- Latest Events by ExploreP2P – a nice summary of the latest situation for both platforms

Consequences

What I wanted to write about are the consequences for investors. Especially those who are beating themselves up because they didn’t do proper due diligence and think they’ll do better in the future.

Everything is incredibly obvious after the fact – the inexperienced team, the grammar mistakes, the unlimited buybacks, I get it. But the question is: would DD really have saved you?

From Kuetzal, in hindsight, it probably would. Too many red flags to jump in, indeed. But for the risk taker tolerant enough to evaluate unregulated, non-industry-leading platforms, eventually, just maybe, there will be a tiny little detail that he may miss… Not necessarily related to internal shadiness – might be just a circumstance, something really unpredictable, a black swan maybe… And all due diligence goes to water making you lose big on the trade.

Although I do think that thorough DD would be amazing, I don’t think that most people are capable of doing so.

And casuals committing to it will most probably end up losing money to inflation due to being too careful… Which may be fine for many, as their losses will be limited to less than 100%.

So, what can you do?

Well, I’m a firm believer in diversification as the ignorant’s way to success.

Let me elaborate.

Kuetzal and Envestio aside, I didn’t do due diligence regarding any of the personal loans I’m funding using the auto invest functionality on other P2P platforms as well. I also didn’t do DD for each and every company in my stock portfolio.

So instead of panicking when things go (or went) south, I addressed the problem up front: by adjusting my asset allocation to be compatible with my risk tolerance.

Many people call this “don’t invest what you can’t afford to lose“.

It’s a sentence that’s common in crypto communities, but applicable to most investments as well.

Whichever way we’ll decide to put it, the point is clear: make sure to have an adequate exposure.

That being said, it still sucks that pulling something like this without consequences is possible in the EU, but I guess that’s just the idealized view a non-EU expat has on the union.

Personal finances, beginning of year

To put what I just explained in the bigger context, let me share how my accounts looked on 17th January, when I did a preliminary check to see where I stand, full portfolio wise.

After deducting the housing and all other living expenses to that point I was left with a number. From this number, contrary to many people’s hopes that the money will be returned, I subtracted my funds taken by Kuetzal and Envestio. At the end, I paid for an all inclusive sunny vacation for two people in the other hemisphere planned for February (I’m hinting at: not cheap).

Why am I saying all this?

The number I ended up with was ~800€ higher than my portfolio value on 31 Dec 2019.

I repeat, after all the losses, after all expenses, after all prepaid costs – I was ~800€ wealthier than the previous month.

Note: this amount was recorded before both my girlfriend and I received our salaries. In other words, we achieved a 100% savings rate.

Okay, once again, why am I saying this?

The keywords are:

- Risk tolerance

- Asset allocation

- Diversification

The more diversified you are the less exposed you are to significant losses. The less assets you allocate to investments riskier than you can handle, the more protected you are from significant losses.

But then, you won’t get a sweet 20% “guaranteed” “passive” “income” to reinforce the feeling of being close to “financial independence“.

Any reward has an adequate risk associated with it, so I doubt that you’d sleep well as a retiree if all your wealth is allocated in unregulated platforms.

… And then a question arises: does it make sense to invest in P2P loans at all then?

Why would I risk an amount within my risk tolerance (let’s say 1000€), so I can earn only 200€ after a year? I’m sure that the feelings of losing a grand are of a higher intensity than the rewards of earning 200€. And if you want a meaningful return, you’ll have to allocate a way higher amount into these platforms – which may be too high for your risk tolerance.

So does it make sense to invest at all? You’re the one to answer. For me, I’d feel way more comfortable with the risks associated with the loans themselves if I knew I was protected against platform risks.

On the other hand, I’m throwing money in the assets of my strategic asset allocation without any doubts. And if I can advise a risk taker (with risk taking willingness and risk taking capacity well aligned) about which markets to enter, the answer would be simple and straight forward:

Stocks & crypto, my friend.

But done the right way – which is something that I’ll refrain from giving advice on and out of scope of this post.

Note: you’d still be exposed to volatility and market risk in general. However, there are no risks of some intermediary running away with your money, having no ownership over your assets, or that strange feeling that you’re a bit too active for maintaining what supposed to be a passive portfolio.

So, not automatic trading, no centralized coins that you need to buy with BTC, but real ownership over your assets. Using a regulated broker to get shares under your name and storing your crypto assets on a hardware wallet.

And to be completely open, this is not a post against the P2P industry. I think Mintos and Grupeer are doing a great job, for example. The point I’m trying to convey is that certain situations are tackled up front. And then, even in the worst case scenario, life will be just fine.

Like mine.

Saving 100% of my salary and then some.

But I kept the loop open for quite long, let’s see how did that happen.

My portfolio performance, January 2020

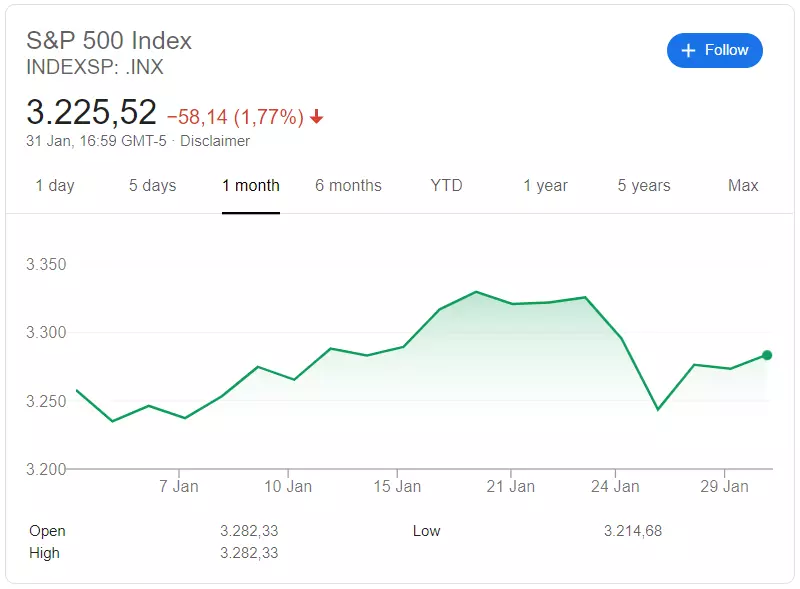

I won’t beat around the bush here. The stocks went on a rally this month.

I’ll let the picture illustrate.

Something I did in the middle of this month was rebalancing of my stock / bond portfolio.

I mean, the gains in the last months were incredible and my allocation of (casual rounding warning) 90/10 was shifted to 95/5.

The market being at all time high, I decided to rebalance “the wrong way”. Okay, not wrong, but in a way I condemn.

I shifted my allocation back to the preferred ratio by selling stocks instead of buying bonds.

So there was no contribution this month but realizing some profit. My monthly cost average amount wouldn’t be able to fill the gap anyway.

I know, I know, I implicitly timed the market.

I did.

Although I’m not approving of it becoming a habit, I’m happy with the decision. Especially after seeing the market’s performance at the end of the month, after the rebalancing. Contributing “accrued” DCA amounts after an at least a 3% correction is not something that hasn’t crossed my mind as well.

By the way, what I talk about is not advice nor recommendation. This is an extra play I did and has nothing to do with my long term strategy. I’m not deviating from my DCA strategy, but acting on top of it.

Enough about stocks now.

Cryptocurrency

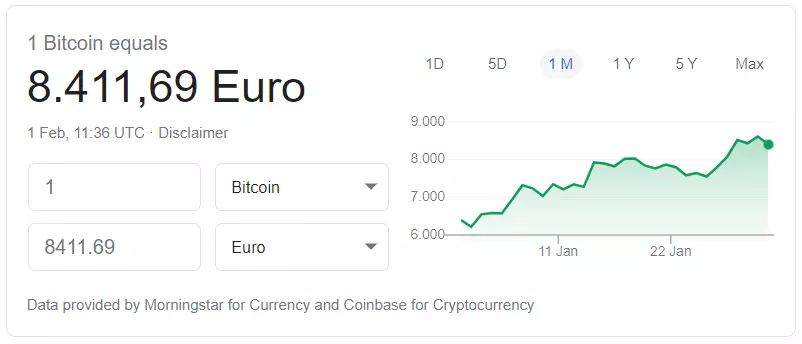

As usual, here’s the chart of BTC as a representative.

So yes, this had a contribution to the perfect savings rate this month.

However, I’m not holding only BTC, but a dozen of alts as well. For example, I received some BSV from the hard fork of BCH in 2018, and just held (or hedl – is it a past tense of HODL?) them in my Coinbase account.

But then this happened.

In words: it more than tripled in value within a month.

I quickly transferred it to Poloniex where I could trade it to BTC and… waited for 10 hours for 36 network confirmations, but ultimately executed the trade.

It was a great month for crypto investors.

I addressed my expectations about all my investments in How I Invest post, so check it out if you still haven’t. Most of my forecasts haven’t changed since then, even with all the new information over these months.

Lastly, when it comes to crypto, if you want to limit the platform risk (the exposure to similar scenarios as Kuetzal or Envestio, internally or externally caused), get yourself a hardware wallet. Many crypto investors think it’s not needed, and they’re right, as nothing is, but I’d highly recommend one.

In case you’re on the fence, I’ll publish a full post about it next week, so subscribe if you still haven’t.

You’ll get a mail each time i publish a new post.

So… How was your January?

How much money did you lose?

Comments: 4

About the Bitcoin. As you may know, BTC halving is coming in few months.

What are your thoughts about that? Last time BTC halving took place on July 9th 2016, the price was at 657,61$. And now its 9319+ dollars.

In summary, I think that the demand won’t go lower and the supply will – the rest is simple economics. Accumulated since the crash and still HODLing.

For more details on my expectations, I’d highly recommend checking this post if you still haven’t. It’s a few months old but my forecasts didn’t change much.

P2P lending is a pretty new concept I think, it’s bound for some scams to happen until it matures. In the past this was rampant with Bitcoin and generally crypto; I similarly lost some amount in the fall of Mt Gox. This is the risk you take for being early adopter, and you’re right the best way to mitigate it is with diversification.

Good to hear from someone who has been around for that long.

But yes, diversification is the greatest protection against big losses. As I recently said: nothing is risky if it’s within your risk tolerance.