Monthly Update: April 2019

A good month.

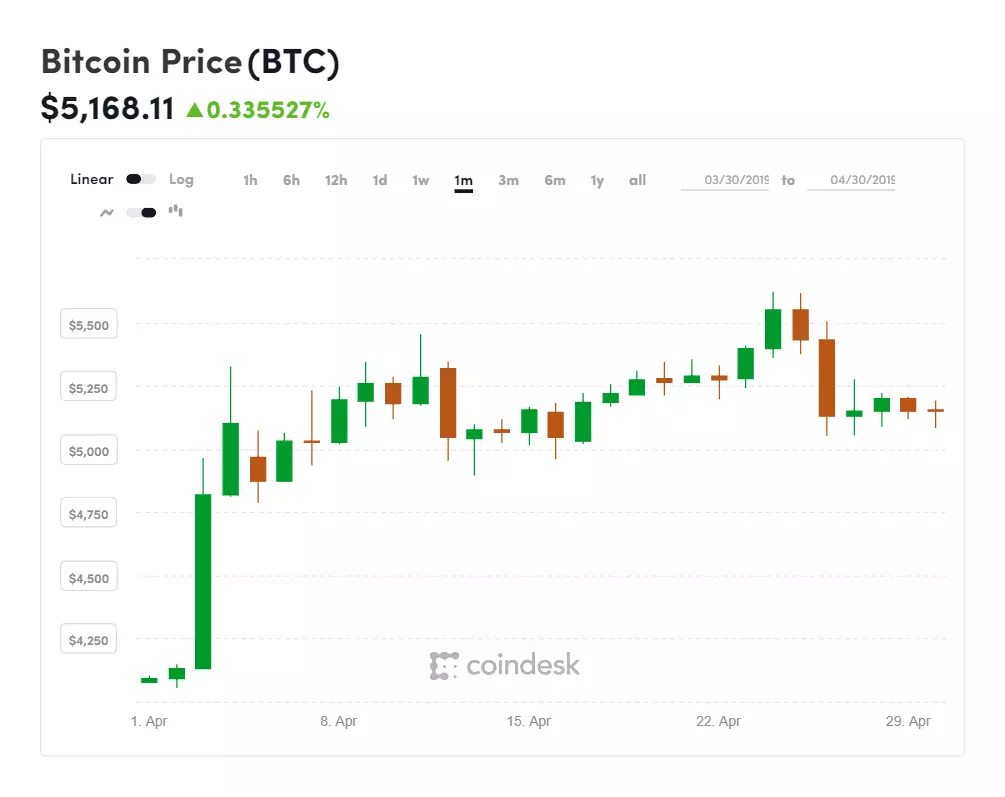

We had a bull run in a bear market, even a potential reversal, and made serious gains with it.

Of course, I’m talking about the cryptocurrency market. There was a 20+% price increase in almost all coins I hodl. The biggest winners were BCH and BAT, touching >60% increase, but ending at ~40% and descending, while my biggest positions, BTC and ETH, finished with ~30% and ~10% gains respectively.

The whole market actually grew really fast at the beginning of the month, but the growth was followed by a drop in the price for most coins. I don’t want to make this a crypto news post, so I won’t go into more details regarding the price movements for each coin I own. I’ll just add that although some coins returned or are slowly returning to their previous month’s value, Bitcoin is starting to show bullish signs and keeps on the pattern after the big green candle.

So yes, it was a good month, but please be aware that this doesn’t mean anything and everything can happen next hour, especially in a market such as crypto – where emotions are still the major factor in the price movements of the coins. The first thing I did after I saw the big jump was going to Google Trends and once again correlating the popularity of the search terms such as “bitcoin” with the respective upswing.

Anyway, the price rose quite rapidly at the beginning of the month, but it seemed like most coins lacked trading volume and tapered off throughout the month. This is another indicator of how big of a role emotions play in this market.

Other Investments

But let’s not dedicate all the attention to the cryptocurrency market when there was another big event happening this month – the S&P 500 hit an all-time high towards the end of April. And it’s the clear winner in my portfolio, when it comes to absolute numbers.

So yes, this month I experienced both crypto and stock market gains.

I didn’t sell anything though. Not only because there was no need to do so, but also because I’m a long-term passive investor and realizing quick profits is an idea I’m not even entertaining most of the time.

As mentioned about my plans in my previous monthly update, I didn’t contribute to my P2P portfolio this month. However, I received interest by all platforms I’m investing through. Checkout the Things I Use page to do the same.

Overall, April was a great month to be in the market.

Other News

The crypto gains were mostly, but not fully, because of capital gains. I’m still selling hashing power through NiceHash, so the amount of BTC keeps getting larger without exchanging it for FIAT.

Apart from the capital gains and losses (XRP finished at ~-7%), there was some other personal finance activities I made. For example, I opened a TransferWise account and would highly encourage anyone to do the same. I won’t list all the services and advantages of doing so, but the main ones are:

- Open EU, US, UK, AU accounts for free

- Hold money in 40+ currencies with no fees

- Lowest exchange rates and lowest fees for currency conversion

- Free debit MasterCard with automatic conversions for spending

Many people use TransferWise for sending money abroad and cash withdrawals, but I only used the above mentioned services so I won’t talk about the quality or fees associated with these. That being said, I already used the card to pay in a currency that I didn’t own and I can confirm that the exchange rate I got was surprisingly low. So, once again, open an account. It’s fast and free and there is literally nothing to lose if you do.

The links are not referral.

April 2019 Asset Allocation

Standard stuff, slightly changed proportions – 49% Stocks, 5% P2P, 5% Cryptocurrency, and 41% in Cash.

Last month I complained that P2P + Crypto make up close to 10% of my portfolio, but with the gains lately, they grew to 10% over the month.

Not much to add about my asset allocation – I’ll keep a similar proportion for a while and will start thinking about reallocating the cash portion into something that doesn’t lose value over time. I’ll be more specific next month.

April 2019 FIRE Progress

My FIRE progress, as seen in the sidebar, went from 35,2% to 37,83%.

With the pace I’m going, the clear path ahead, and the confidence I have in what I’m doing, although more than half way to go, it feels like I’m getting really close to the goal. And it really feels good when I know that I just need to keep doing what I’m doing in order to achieve it.

I think it’s realistic to hit 40% by the end of the next month. It’s not a rush, but yeah, if I could go ahead and do that, that would be great.1

No Comments