Mutual Funds (Introduction to Investment Funds)

In the previous post, you learned about index investing.

The first step to implementing such an investment strategy is understanding what mutual funds are.

Mutual Funds

Directly from Investopedia:

A mutual fund is an investment vehicle made up of a pool of money collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and other assets.

All the funds’ investments are part of a common portfolio. When a new investor enters the fund, their money are pooled with other investors’ money.

When an investor invests in securities through a mutual fund, he is actually buying shares in the fund.

And the value of the mutual fund itself is based on the performance of the securities it invests in.

The Benefits of Mutual Funds

If buying a share in a mutual fund is almost the same as buying a share in a company, why would we want to use funds instead of buying the actual stock?

Well, when you put your money in a mutual fund that manages a stock portfolio, you end up owning shares in those companies automatically. So, the key difference, and main reason, to go with funds is diversification.

I’d be way more comfortable having $100k distributed across 500 companies than invested in one.

Compare what happens when a single company goes down in both cases. Of course, diversification will also mean less gains if a single company sky-rockets. But limited gains is the price we pay to limit losses.

Basically, the advantage of mutual funds is that you buy a single stock and let professional management take care of the rest.

For this service, of course, you pay a fee.

Actively vs Passively Managed Funds

The investment funds can be actively or passively managed.

Active management generally means that the fund tries to beat the market. This usually means outperforming some market benchmark, such as an index.

That makes active management more complicated, as it may include more advanced strategies than just buying shares. This doesn’t require any investor involvement, but makes the management fees higher.

Passively managed funds, on the other hand, don’t attempt to “beat the market”. They usually have a pre-defined portfolio, oftentimes tied to an index.

Mutual funds that track an index are called index funds. They’re the most popular type of passively managed funds.

As it requires less involvement in terms of management, the fees of passive funds are usually lower.

The Reality of Active Management

Read the following paragraph carefully:

Every year, many actively managed funds outperform their target benchmarks. But no actively managed fund outperforms its target benchmark every year.

In other words and in the most simplified manner possible: beating the market consistently is close to impossible.

There’s a saying that the only person who is getting richer through active portfolio management is the portfolio manager.

This brings us to:

Management Fees

A management fee is an expense the investors pay to cover the operational costs of the fund.

These expenses are annual and listed as a percentage of the investor’s portfolio value. Some mutual funds also have deposit or withdrawal fees.

I’m preparing a post on Full Breakdown of Investing Costs, so subscribe below to get notified when I publish it:

But I already ran the numbers and calculated how much difference a 1% fee can make.

If you prefer to see the conclusion directly:

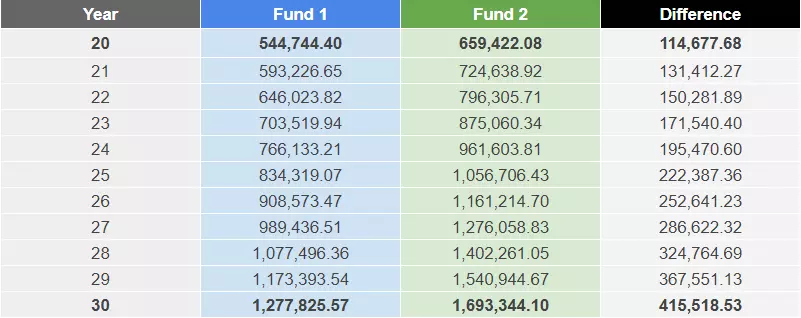

- With a 0.1% annual fee, a one-time investment of $100k left for 30 years leaves will grow to $1.69m

- But if the fee is 1%, the same investment will grow to $1.27m in the same period

The total difference in the portfolio value is $415,518:

In investing, it’s important to remember that you’re in it for the long-term.

That means that any value you lose in fees is a value that won’t grow through the magic of compounding over the years.

So the most important take-away: be mindful of funds’ expense ratios.

Next steps: Index Funds

You should already have a basic understanding of both index investing and investment funds.

Both of these synergize into something we mentioned already: index funds. Learning about them should be your natural next step.

Remember, If you prefer an all-in-one introduction to investing, visit Become an Investor. Otherwise, subscribe below and await the next post on index funds:

This post is Part 4 of the Investing for Beginners Series.

- Previous post: Index Investing – A Gentle Introduction

- Next post: (coming next week)

No Comments