On Sticking to Your Strategy (March 2020)

I guess this post qualifies as a monthly update.

However, what I’ll share is applicable to any period in a long-term investor’s horizon, so take notes.

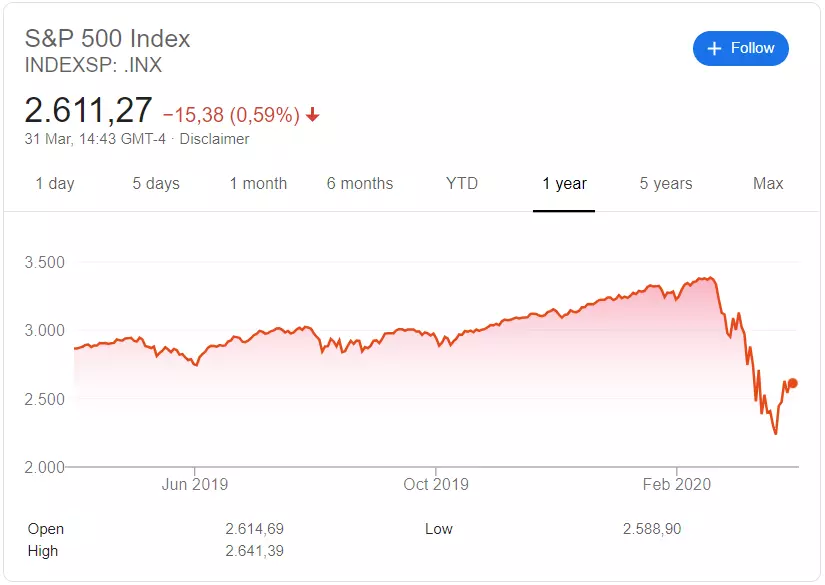

But as we do every month, here is the S&P 500’s performance:

I was thinking about showing the graph of my portfolio instead of an index, but that won’t represent the casual’s reality that closely, as personal factors I’m used to (such as salary, spending habits, and reporting standards) may leave certain readers with a lot of unexplained deltas. It’s a great idea though, so maybe I’ll adopt the model in the future. My asset allocation is quite different and enriched since the last time I shared it.

Anyway, I’m doing fine.

And, as a long-term investor, you should too.

If you’re panicking and have the urge to ask “how come!?”, let me help you figure it out. We’ll analyze this strictly from long-term investing perspective and explain why you shouldn’t panic, why you shouldn’t be worried, and why you should stick to your strategy.

Let’s dissect all the scenarios that may happen.

Scenario 1 – The situation improves from tomorrow

This is not an unlikely scenario.

The situation might be under control and the economy might start recovering from tomorrow. The market may be too forward looking that everything that may happen is already “priced in”. Plus, there is the Fed doing everything possible to end the bear run.

Then, you’ll be relieved as you won’t see your portfolio go lower than it currently is. It didn’t hurt that much, did it?

It’s a double edged sword though. The worst thing about this scenario is that it lasted too short. That a recession was not official and the ammunition required to aim at one was wasted on manipulating the economy.

In other words: enjoy seeing beautiful greenery, but this just postpones the inevitable.

If your hands were just about to shake but still didn’t, you might consider rebalancing your portfolio to a higher cash allocation once the S&P 500 reaches the ATH territory again.

And the good news: you have the option to build your portfolio with the prices from 3 years ago.

But what if this doesn’t happen?

Scenario 2 – Bear market for 12-36 months

This is also not an unlikely scenario.

As Peter Schiff says, paraphrased: “people focus so much on the needle that they don’t see the bubble” – the market was (is) overvalued and there was (is) no solid foundation supporting the prices. The coronavirus just started what would’ve happened anyway.

Think about it – the above mentioned initiatives such as 0% rates, no reserve requirements, potential bail-outs, aggressive quantitative easing and government spending is like playing Jenga on an shaky surface. And once we declare a victory over the parabolic rise of the pandemic, we may see the economy collapsing as it was due.

We may be in a recession and it may be official from tomorrow.

It may turn into a depression and we may see 2-3 years of rising unemployment, poverty, deflation, defaults, new regulations, debt forgiveness, and ultimately wealth redistribution.

Whatever it is, it doesn’t scare me. This time is not different. Maybe just on the surface (the needle, remember?). As long as the world exists as we know it, this too shall pass. Your focus should be to end up on the winning side after the fact, as there is not much to do as an individual to prevent further damage.

If you weren’t loaded on cash, preferably in the form of banknotes – as the banks own your every penny since the reserve requirements were lowered to 0, you might not end up in the top 1%… But most probably you’re not enjoying such a status now anyway, so… Just relax.

But the bottom line… You bought the same ETFs, with the same dollar amount, every month, no matter what, right? Eventually entering a bear market should also have been a part of your strategy as a long-term investor. Otherwise, why did you DCA?

If you’re the lump-sum type, each investment should scream “I’m in it for the long-term” and “I don’t time the market” in your name.

And if you waited for the bottom, maybe it’s got time to start dipping in the markets slowly.

Scenario 3 – Armageddon

This is an unlikely scenario.

Anyway, let’s entertain it.

Short and simple: if the empire fails, nothing will matter.

Whether you kept your wealth in cash, redistributed among various currencies, government or corporate bonds, value or growth stocks, precious metals or real estate, it won’t matter. Everything becomes correlated if we’re entering a scenario such as this one.

You even may have had a sneak peek already, as you saw crashes in stocks, bonds, and gold at the same time. There is no surprise if real estate follows in a month or two.

But whatever happens, here’s the takeaway: You can’t lose.

You won’t be left behind.

You’re one with the world.

And we’ll all go down.

So, our lives might suck for a while compared to what we were used to, but in relative terms, we’ll do just fine.

Although I don’t expect this to happen, I’m exposed to asset classes considered “risky alternative investments” as a hedge against the eventual guaranteed financial collapse. This rate of devaluation of the FIAT currencies can’t last forever. Another generation or two at maximum.

But that’s a story for another time.

Last resort – rebalance

Lastly, panic aside, if you’re forecasting that the market will go even lower, again, don’t change your strategy.

But I understand your point – economic growth is a function of productivity, which is currently low and will be for the foreseeable future. Meanwhile, debt availability, low rates, QE… Printing money… Alchemy… Are all keeping the economy on life support, but that’s not a solution. You know a bull run won’t last but don’t want to panic sell…

I’d still advise you to stick to your strategy, but there is one thing you could do: It’s MonkWealth approved to rebalance once. If you want to hold more cash and shift your allocation a bit, once, do it now. And never think of it again. That’s your one and only option of timing the market.

Then continue DCAing as you previously did and reenter when you think valuations are more aligned with the reality. And be prepared to miss out on mad gainz if you’re wrong.

Nothing makes sense in times like this, so the smartest thing to do is not deviating from your long-term strategy.

And for those that need some help starting out, Become an Investor can be a great resource – probably the only one you’ll need.

No Comments