Total Expense Ratio – The Importance of Keeping it Low

The Total Expense Ratio (TER) is the annual cost an investor pays while having an investment in a fund.

From Investopedia:

The total expense ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund. These costs consist primarily of management fees and additional expenses, such as trading fees, legal fees, auditor fees, and other operational expenses.

Table of Contents

TER (Total Expense Ratio): Introduction

The TER is not an “extra cost” you’d need to pay in cash year after year, but an amount that will be automatically deducted from your portfolio by the fund.

Every fund, whether it’s a mutual fund, index fund, or an ETF, will have an ongoing charge – the total expense ratio.

It is represented in percentage terms and can be found in the prospectus for any fund you’d be researching.

The Key Facts for the CSPX ETF, highlighting its low TER of 0.07%

Note that the less involvement the management of a fund requires, the cheaper it will be. So index trackers will always be cheaper than actively managed funds.

Of course, as a “passive investor”, you’re not really interested in those anyway… But it’s worth mentioning that there are funds charging as high as 2% per year.

Why is a low TER so important?

Let’s take a look at two funds that yield the same hypothetical returns, but one is more expensive than the other.

Let’s say we’re investing $100k in a lump-sum manner for a 20 year time horizon, assume a 10% yearly return, and we will ignore taxes.

Fund 1

The first fund has a 1% entry fee, an ongoing TER of 1%, and eventually, a 1% exit fee.

- So, 100,000$ – 1% entry fee = 99,000$

- After 20 years, at 10% growth and 1% management expense per annum, the 99,000$ would be worth 544,744$:

Calculation: X = X-1 * 1.1 * 0.99

- When withdrawing the amount, we pay a 1% exit fee and we’re left with 539,296$.

Fund 1 final value: 539,296$

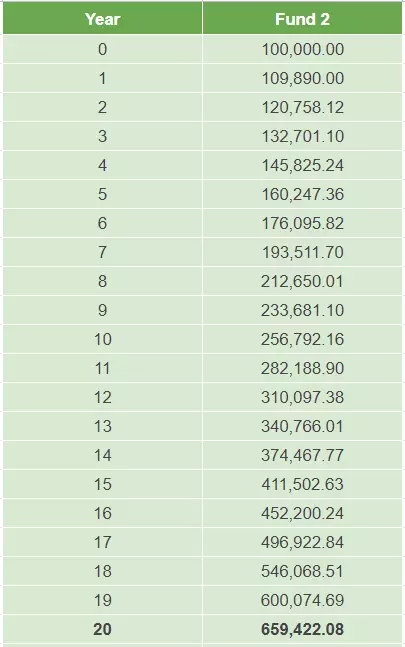

Fund 2

The other fund has no enter and exit fees, but just an unavoidable expense ratio of 0.1%.

- After 20 years, at 10% growth and 0.1% expense per annum, the $100k would be worth 659,422$.

Calculation: X = X-1 * 1.1 * 0.999

Fund 2 final value: 659,422$

Conclusion

in summary, the greater the expense, the lower your returns will be.

If you invest in a fund with a TER of 2% and your investment grows 10% during the year, your actual return would be only 8%.

As mentioned earlier, index-tracking funds’ costs are rarely that high. This is especially the case in developed countries where the funds must offer competitive prices in order to keep their clients. However, we see that even a seemingly small difference of sub-1% can make a drastic difference in your portfolio’s performance over the years.

In this post’s example, they made a difference of more than $100k.

So remember, there is a single parameter that will determine how your portfolio will perform over the long run:

The cost.

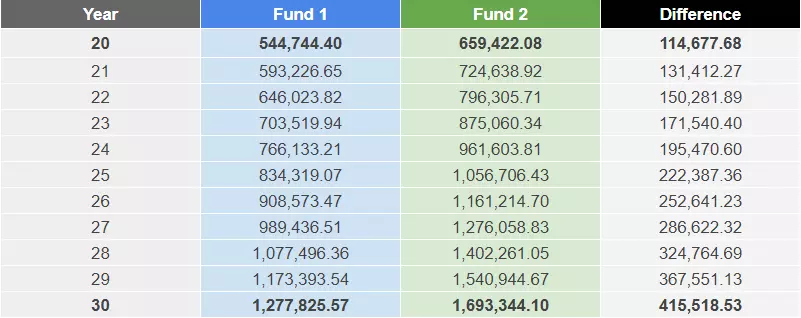

Difference After 30 Years

And it gets worse as time goes by.

Below is the difference in performance of the next 10 years:

Difference in performance of a fund with 1% TER (Fund 1) and a fund with 0.1% TER (Fund 2)

And note, the TER is just one type of cost.

Go to the following link to see the others: Investing Expenses – Full Breakdown.

If you’re interested in fully understanding the way to pick low-cost ETFs for your portfolio, you’d enjoy reading “Become an Investor” – the most comprehensive introduction to passive investing out there.

If you prefer a free resource, I also have a beginner series on my blog:

How to Start Investing: A Complete Beginner Series

No Comments