A Glimpse Into My Portfolio (2020)

As most readers know, I stopped being too transparent about my portfolio, asset allocation, and overall investment strategy over time.

My reasoning behind it is, first of all, because I couldn’t see any benefits of total transparency. There are absolutely no positive things that can be a consequence of the world knowing how much you’re worth, how is your wealth allocated, and when will you reach “FIRE“. And when the best possible outcome is neutral, an instinctive risk/reward analysis points you to the answer of whether you should do it or not.

Apart from that, sharing the exact holdings in my portfolio can only motivate people to do the same without doing the research themselves. Many followed up by mail and we had chat to go over their allocation and strategy, but taking one’s situation into account is a completely different game than recommending generic products / platforms / strategies. Investing isn’t generic… Anyone considering starting should understand his risk tolerance and set an adequate asset allocation. From there, it can become more non-specific – cost average, diversify, time in the market beats timing the market, all that good stuff.

Anyway…

I’ll make an exception to this rule.

I won’t be fully transparent but want to give my audience a glimpse into parts of my portfolio.

As many of you know, I’m a big promoter of passive investing using a diversified index as a benchmark. I have dozens of investment posts where people can learn how to do it themselves. History shows that matching the market brought better performance than anyone’s who tried to beat it continuously, so I’m more comfortable with being sure I’m smart all the time than taking a risky chance of being a genius over and over.

However, I currently see opportunities that can be taken advantage of, so apart from my strategic asset allocation I also have a tactical one. Tactical Asset Allocation is an allocation that depends on current events and market conditions rather than solely on the investor’s risk tolerance, investment horizon, or long-term goals. It’s more active than maintaining a globally diversified portfolio and with the goal of realizing even more profits.

I have a few more asset classes in my portfolio, but I’ll stick to the 3 I want to talk about here: cash, stocks, and crypto and my current allocation of roughly 40/35/25 respectively. This is quite different from what you’ve seen last time I shared my allocation, where stocks had more weight. Ultimately, it should come back to that. But note, I’m not saying that this allocation is “correct” and especially not strategically for the long run. However, I have reasons why it’s currently so – let’s see them one by one.

Note: this is not my full portfolio – I’m also invested in bonds, precious metals, real estate, and P2P. I focus only on a subset of asset classes for the purposes of this post.

Stocks

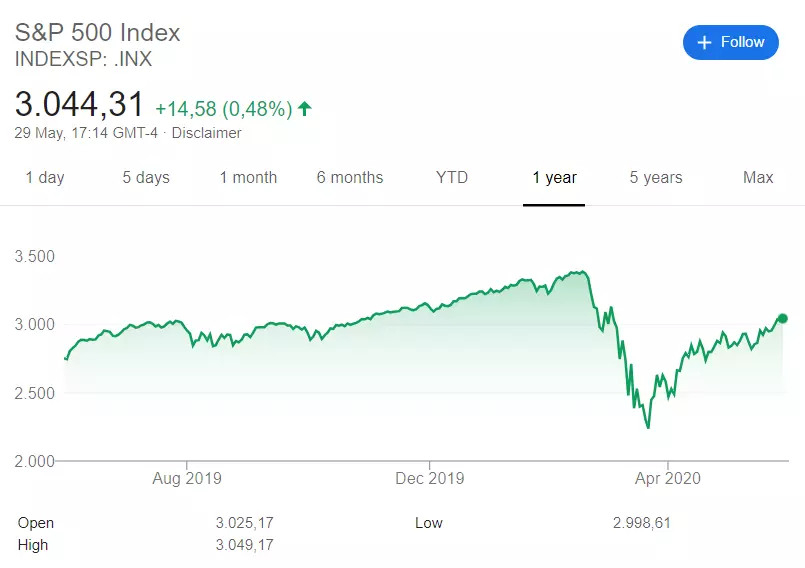

So, the pandemic crash happened and here we are. It’s a bit better than March, but still not fully recovered.

Many say that the stock market is overvalued and doesn’t represent the current economy. They’d be right, as the current productivity is too low for such a growth. The GDP dropped significantly and we haven’t seen such high unemployment numbers since the great depression. The subscribers to these ideas see the “recovery” as a dead cat bounce headed towards a financial crisis.

There is the other side though – people who say the markets are forward looking. They’d also be right. The investors’ expectations of recovery in the future are priced in. With a bit of a push from quantitative easing and rate cuts, all deployed a bit too early in my opinion but who am I to say, the S&P again went above 3000 just like that.

Maybe it’s a mix of the two. Maybe the markets are forward looking and will ultimately recover but new information will cause another 40% drop in the stock market. Maybe the stock market is artificially pumped by cheap money and expansionary regulations, so it’ll be unsustainable to keep without a solid foundation (think revenue, GDP, fiscal balance, etc.). Maybe the worst is behind us and maybe it’s yet to come. Or maybe neither – a slow recovery taking years to reach previous highs.

And about me? I cost averaged with slightly higher contributions than usual. But as you can see from my cash-heavy allocation, I haven’t been as aggressive as I could’ve. Thus, maybe I have missed the bottom, maybe there’s another one to come. Nobody knows. I’m not worried one bit and ready to handle a stock market crash the right way. Unless it’s a V shaped recovery and the bull keeps running.

Whatever the case is, at a certain time in the future… The near future… Depending on Q2 results might be earlier rather than later… Or depending on the outcome of the presidential election, may be in a few months rather than years… Whenever it is, eventually and in not so distant future, there will be a global recession.

This is a fact.

A recession doesn’t mean a stock market disaster. A recession doesn’t mean a guarantee for best valuations. However, I’ll use it as a hands-off signal to trigger my entry point where I’ll drop the cash with 3 equal monthly contributions in the following 3 months.

That’s how I’ll eliminate my emotions, expectations, and potential mistakes from the decision.

And of course, meanwhile I’m sticking to my strategy and keep DCAing with a part of my income.

Cryptocurrency

Apart from my stock investments, as many readers know, I’m a big supporter, promoter, and investor in the cryptocurrency market. But even if we put aside my admiration of decentralization and real ownership, equally valued global currency, as well as my knowledge and thus distrust of the modern monetary systems and policies, I’m seeing an opportunity in crypto as a trader as well.

Bitcoin went through its third “halving” event on May 11th. I already explained what this means in this post, but basically, there was a supply shock in the market. With the demand being stronger than ever, and only increasing, it’s the simple law of supply and demand which will determine the price from here.

Why all this is worth mentioning? Because I think there are frequent opportunities of doubling an investment or losing an investment in the crypto markets all the time. For example, I sold my ZRX position this month when it spiked without correlation to the rest of the market. But talking in terms of 5x, 10x, and even higher returns… Those can be seen and forecasted from a market cycle perspective. And although BTC will lead it, the altcoins follow during a hype cycle. Some more and some less. That’s why I’m diversified in the market as well, owning: BTC, ETH, LTC, XRP, BCH, ATOM, XTZ, XLM, and smaller allocations in a few smaller, more speculative coins – all securely stored on my Ledger Nano S.

If you’re new, you should read more on securely storing your cryptocurrencies.

Anyway, explaining all the details is too long to include here, but I already did it a few months ago. To see my Bitcoin forecast and reasoning behind it check out the following post: Bitcoin Halving – Everything You Need to Know.

Thank me later.

Warning: I’m taking a risky position here. Did my due diligence and do yours. Both my cash and crypto allocations will shift in both directions in the long run.

Other Updates: FIRE Merch

A couple of months ago I started the MonkWealth Merch Store.

I put it silently in the sidebar because I couldn’t announce it explicitly earlier, as there were more serious issues throughout the world and it felt like a wrong time to advertise T-Shirts.

Even now actually… Save your money and don’t buy any… Unless you’re doing fine and a design resonates with you. 🙂

You’ll never know until you visit the store by clicking on the link or picture below: FIRE Merch.

No Comments