In the last post we covered asset allocation and until now you should have a pretty good idea of how you want to distribute your money. Leave a comment about the allocation you ended up with.

So, you know that you’ll be [X]/[100-X] in stocks/bonds, but how do you do it? Will you just log in to some broker and dump your money in the ETFs you chose or you’ll do it gradually? Will you do it on a predetermined frequency or you’ll wait for a certain percentage of movement in order to make a purchase?

Deciding on an investment strategy is as much of a challenge as choosing a preferred asset allocation, or even the right ETFs or index funds. As with many aspects of investing – you can only know what was right after it happened.

In the next section we will take a look at a few strategies you can take when it comes to actually putting your money to work. We’ll also dive in in the pros and cons associated with them during both good and downturn economy. Let’s get to it.

Investing Strategies

Strategy #1 – Lump-Sum

A lump-sum payment is a term used to describe a payment that happens once, at a particular time, as opposed to multiple smaller payments.

In the context of this post, let’s take an example of a person who decided to start investing. Our subject is comfortable with investing $10k in an all-stock portfolio, tracking a diversified world index, such as the MSCI World. That means that he would log in to his brokerage account and simply dump his money in an ETF tracking the index.

When observed for the first time, many people would have a tendency to consider this strategy naive, stupid, or even gambling. But is it really? In the What is Investing post I gave a practical example of someone who tried to time the market and to buy low. Even if the reality matches the investor’s forecast, we should remember that this is not what we’re actually trying to do as passive investors. For more details on why timing the market is not the best long-term approach, I’d recommend distinguishing between trading and investing.

The bottom line is: since timing the market is nearly impossible, you should just dump your money using the allocation you chose and let time take care of the rest. Don’t forget that betting on the world’s economy is a pretty surefire long-term strategy. Or you need a reminder?

However, as with most things related to investing, there is some uncertainty with this approach. Let’s see what happens if we get lucky and what happens when we don’t.

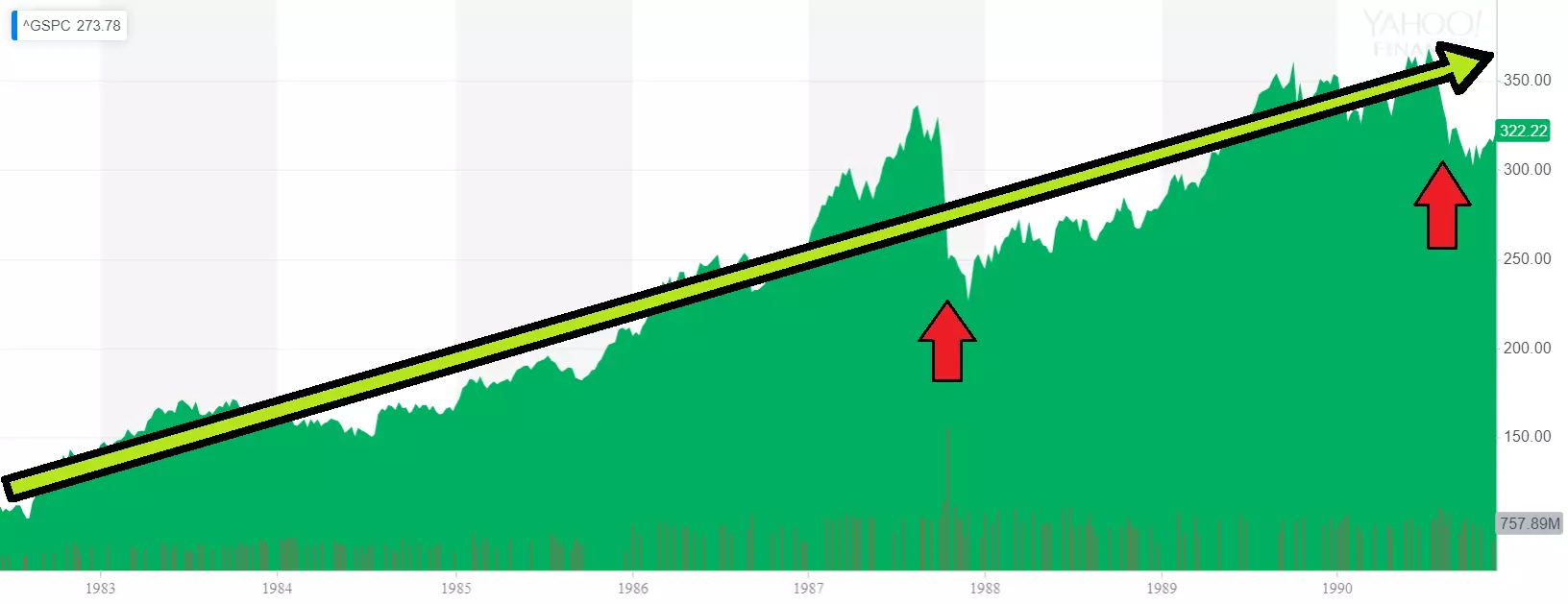

Lump-sum at the beginning of a bull market

If it turns out that we dumped our money in the stock market around the beginning of a bull run – that can be considered a perfect timing! But please remember that perfect timing is not our goal, it’s just a nice side-effect of how things turned out.

This would mean that our investment portfolio will start at the bottom and will experience growth during the full bull run… Until the next recession, where the losses won’t even bother you with all the compounded gains you realized throughout the years.

This is the best case scenario.

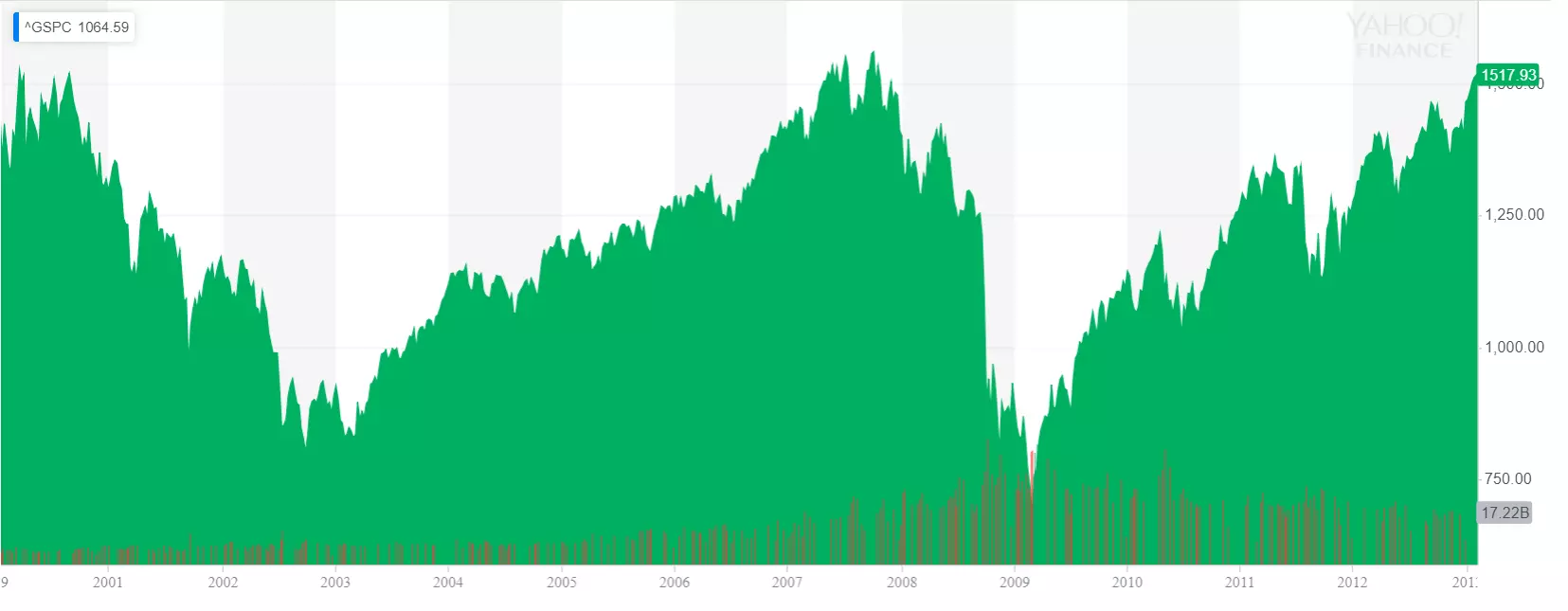

Lump-sum before a recession

Long story short: this is the worst case scenario.

Because we can’t time the market, we can’t know what will happen tomorrow. So we may experience dumping all our money in a stock portfolio and waking up the next day to see that it’s 10% down. We do the right thing by not selling at a loss and see our net-worth being more than 50% down over the next couple of months…

Imagine putting all your savings in an S&P 500 fund in 2000. You’d go through the dot-com crash, recover over the next 7 years, just to experience another severe recession (a great one), and wait a few more years just to break even.

Entering before a recession is the worst thing that can happen in regards to a lump-sum investment strategy. Notice that entering a year earlier or a year later would make this a completely different experience. That leads us to:

Anything in between

Okay, the last section might have made you more scared of investing than you actually were. Especially in the current environment when analysts predict another recession in the next couple of years1, the yield-curve inverts, and we’re in the longest bull market ever. And although it’s true that anything can happen at any time, let me tell you what’s the most probable scenario.

Anything in between is the actual period in which you will most probably enter the market. Not only it’s good enough for a lump-sum strategy, but it also embodies the slogan “time in the market beats timing the market“. It ensures that you’ll be in the market for as long as possible.

Of course, there is a infinitesimal risk that there will be a market crash an hour after you invest, so the question you should ask yourself is: how are you preparing for an unpredictable event that happens once per decade? You don’t.

Or maybe you can…

Strategy #2 – Lump-sum after a crash

So, this is another lump-sum approach, but eliminates the before a recession and the anything in between options. With this strategy, you won’t actually predict when a market crash will happen (because you can’t), but you will wait for it.

By not entering the market, you would keep your wealth liquid (i.e. in cash or savings account), until you start seeing the economy recover after the next stock market crash. And yes, this is the best moment to enter the market. But what happened until then?

Let’s say you decide to use this strategy and the next recession hits within the next year. Perfect. Enjoy a lifetime of portfolio growth.

But let’s say that after two years you’re still waiting for the recession. Another year passes by and you still do… Five years later, there were a few corrections refreshing the stock market, but still no signs of a recession. Even if there is a market crash right then, think about what you’ve lost. Let me list a few things:

- You lose a portfolio growth averaging at around 10% per year2

- You lose dividend payments, maybe reinvesting them, and the compound effect

- Opportunity cost, because you lock your money in waiting mode for an unpredictable event

- Your money losing value year after year because of inflation (highly recommended read)

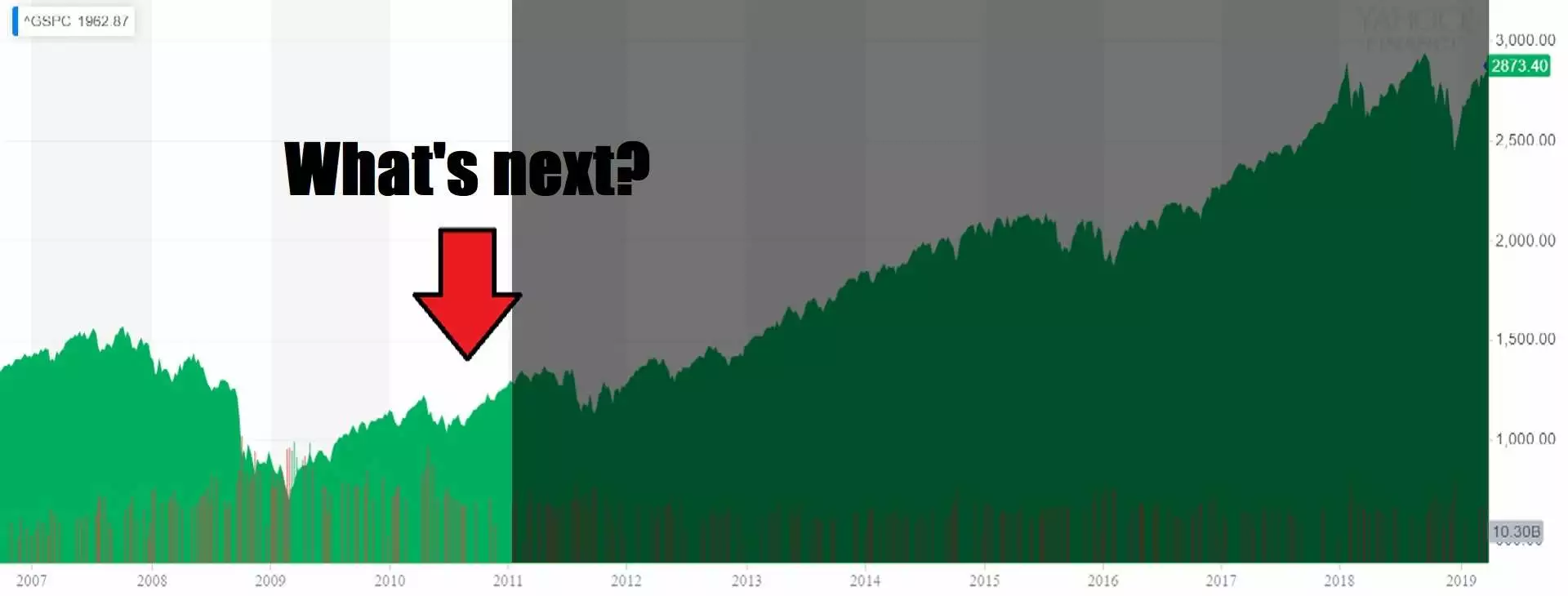

So, imagine that someone with a post-recession trauma thought that the stock market is overvalued in 2010 and decides to wait for a crash before entering. That person would still be waiting, and more likely than not, the next recession won’t even touch the levels he missed by not entering earlier.

On the other hand, the one who believed that the stock market is experiencing a recovery, would do an exact lump-sum after a crash and get rich riding the longest bull run.

If you’re serious about a lump-sum after a market crash, this strategy can be really profitable, but post-recession sentiment is something that won’t let you think as clearly as you do when times are good. And you would also be guilty of trying to time the market, because that’s what waiting for a crash is.

Dollar Cost Averaging (DCA)

DCA is a strategy where an investor buys a dollar amount of some asset on regular intervals.

Dollar amount means that the we don’t think in terms of how many shares, but in terms of how many dollars.

For example, let’s say a person earns 2000$ and can afford to invest 500$ each month. The first month, he gets paid and logs in to buy his ETF of choice. The price per share is 5$. It doesn’t matter – he buys as much as he can with his 500$. Next month, the ETF’s price increased to 7$. Again, it doesn’t matter – he buys as much as he can with his 500$.

So, it’s not 100 shares in January and 71 shares in February, but it’s 500$ each month. So, what are the scenarios using DCA?

- By starting at a start of a bull market, your gains are lower than with a lump-sum because you gradually build your portfolio over time. Still a great time to start investing, though.

- By starting right before the inevitable market crash, only the first months’ amounts will be affected and the rest of the contributions will catch the inevitable recovery.

- And starting anywhere in between works just as well – smoothing the volatility on both sides and allowing you to pay yourself first as you earn.

I think that DCA works really well for people in the workforce who save a portion of their income. Even if you do a lump-sum at the beginning, you will still have some surplus each month ready to work for you. And I would recommend it to most readers of the Become an Investor series, as I’m sure that not everyone would be comfortable dumping a large amount of their savings in stocks without previous investing experience.

Actually, DCA is also my strategy of choice, although I experimented with different dollar (or euro) amounts and will always adapt it to my current situation. However, some investors swear in the lump-sum strategy and some in investing when valuations are better (after a crash) so make sure to assess your situation and determine which one would work best for you.

Investing Strategies Summary

The strategy you’ll choose will have a big impact on how your portfolio will grow. If we get into the exact numbers, the lump-sum after a crash would perform the best, while the lump-sum before a crash would perform the worst. However, the first one can back-fire and leave you out of the markets for life, while the second one is an extremely unlucky event. DCA is the middle ground that works for most people and can be supplemented with extra lump-sum investments should the circumstances arise (EOY bonuses etc.).

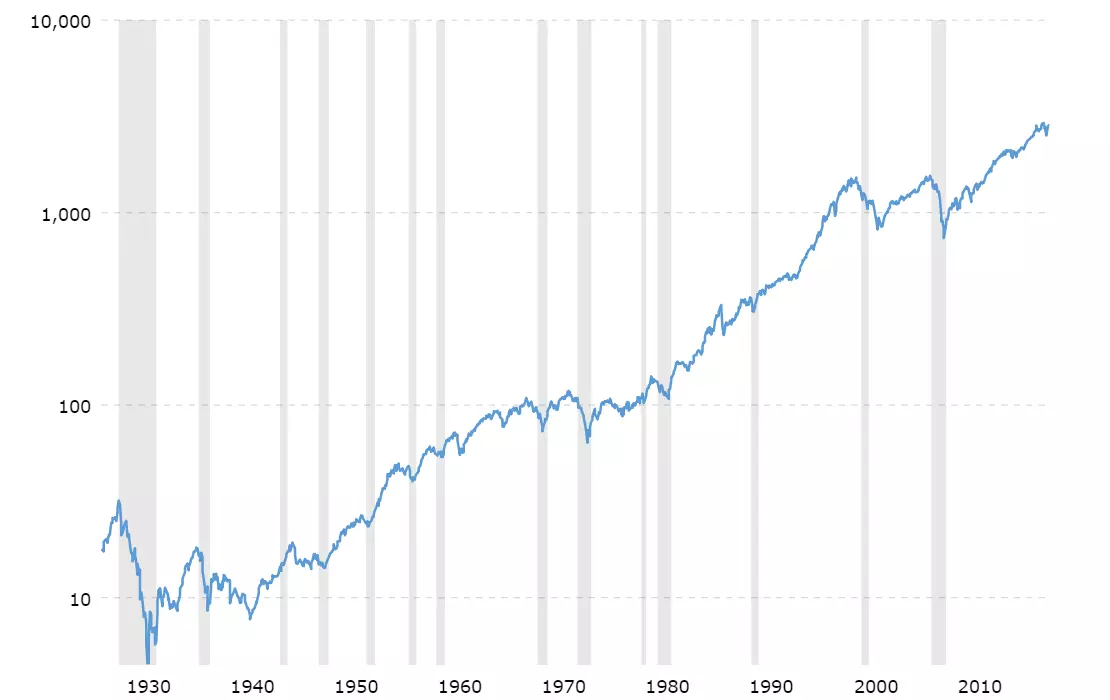

And whenever things get overwhelming, you should remember the time horizon that you’re investing for, the long-term, and remind yourself how the stock market performed through the years of volatility, corrections, bear markets, and recessions.

And just so you don’t get overconfident, also remind yourself that past performance does not guarantee future results.

So, your turn. What’s the asset allocation you ended up with after reading the last post and which investment strategy would you pick?

Previous Become an Investor Post: Asset Allocation

Next Become an Investor Post: Trade Life Cycle, Placing Orders, and Rebalancing

PayPal.me/MonkWealth

PayPal.me/MonkWealth