Bitcoin Price Forecast for 2020 and 2021

I struggled with the dilemma of writing a post like this for a long time. However, I feel like it’s almost a last chance to express my thoughts before it’s too late.

But first thing first…

Read this carefully: I have zero interest in you investing in Bitcoin. Absolutely nothing. This post doesn’t contain affiliate or referral links, offers no financial advice or recommendations, and condemns people of making any decisions based solely on what they read on MonkWealth.

So, here’s an advice: if you don’t know exactly and in tiniest of details how the blockchain works and what you’re doing, don’t invest in cryptocurrency. You’re likely to misinterpret many of the things you’ll consume which will expose you to more risk than you can tolerate, financially and emotionally, and you’ll be left with nobody to blame but yourself. So don’t do it!

With all that said, I’d like to discuss Bitcoin as an enthusiast and supporter first, and as an investor second. So let’s start with some background.

Distributed Ledger and Bitcoin Ownership

Basically, the Bitcoin blockchain is a decentralized distributed P2P network. That means that there is no central authority that controls the transactions or ownership of bitcoins, no single point of failure, and hence it’s not based on trust – which is something that’s assumed / enforced with conventional financial institutions.

But then who guarantees the legitimacy of each transaction? How do we know how much BTC does everyone posses?

Well this is visible in the blockchain itself. It represents a distributed ledger that contains blocks of all transactions that ever happened, which is sufficient information to derive how many bitcoins are there on each address.

Its distributed nature prevents people of changing past transactions or fake a number of coins in a wallet, as every participant has a copy of the ledger and it’s continuously verified by the network.

You can see the most recent Bitcoin blocks and transactions on Blockchain Explorer.

Bitcoin Transactions

There is a lot of ground to cover in order to explain what exactly happens here, so I’ll abstract away enough to convey the point without diving too deep into the technical details.

When it comes to the transactions, a transaction message (from, to, and amount) together with a hash is broadcast to the network for verification and confirmation.

I’m aware that some readers may be unfamiliar with what hashing means, so just briefly: it’s a process of converting an input to a fixed size output using a cryptographic function that is irreversible (meaning it’s computationally easy to get the output given an input, but computationally infeasible to get the input given an output) and deterministic (meaning that the same input will always produce the same output).

Bitcoin uses the SHA-256 hashing algorithm. For any input, it produces a fixed size string by which it’s virtually impossible to get to the original input.

For example:

SHA(“moon”) = 9E78B43EA00EDCAC8299E0CC8DF7F6F913078171335F733A21D5D911B6999132

So if we have the word “moon” we’ll always get the same hash. But looking at the output, we have no way of figuring out what the input string was…

Unless we guess.

But we’ll need to go through all possible combinations of characters and eventually get lucky, which can take a massive amount of time and/or computing power.

If you want to try this yourself, go to a SHA256 hash generator and try finding a sequence of characters that produce a hash beginning with 10 zeros. After a few tries, you’ll see that it’s pretty improbable to do it by sheer luck and only achievable if you keep guessing indefinitely.

Going back to bitcoin transactions, and withholding further technical details, this type of guessing is what the network participants called miners do to confirm the transactions and add blocks to the blockchain.

They (we) allocate computing resources and compete with each other to find blocks because of the incentives to do so. It’s a mutual benefit – the network becomes more reliable and the miner who finds a block is rewarded with BTC to his wallet.

Important

I intentionally left out many details about this process because that will need not only a post, but a series of posts in itself.

The technical details behind this process are not a prerequisite for understanding the rest of the post or the price forecast that comes afterwards.

So don’t worry if you’re a bit confused or feel like something was left out.

However, it’s important to understand that the miners are responsible for the network’s reliability and are rewarded with BTC for every mined block.

Bitcoin Block Reward Halving

It’s important to note that every bitcoin ever created was created through mining.

When Bitcoin started (January 2009), the reward for finding a block was 50BTC. So approximately every 10 minutes (average time to mine a block), a miner was granted 50BTC to his wallet.

Sounds like a lot in today’s terms, but the price of Bitcoin back then was just a few cents.

Anyway, increasing the money supply is not something we’re unfamiliar with. We know that it makes a currency lose purchasing power and causes inflation.

So how is Bitcoin different that FIAT money in this sense?

First of all, Bitcoin’s total supply is capped at 21,000,000. The limited supply is an idea that makes it similar to gold (some even call it “digital gold” and we still haven’t mined all bitcoins). As you may notice, this prevents the inflation of getting out of control, which is a common case with other currencies, none of which are backed by any asset.

Side note: some people think that gold has intrinsic value because they can touch it, while Bitcoin doesn’t because it’s digital. They need to be reminded that the price of gold is also determined by its perceived value – same as Bitcoin or anything else.

Back to the topic, there is another characteristic that’s really important to the Bitcoin’s deflationary nature. It’s the block reward halving.

Approximately every 4 years the amount of reward the miners get for mining a block gets cut in half. This is part of the code behind Bitcoin and is a fact.

As mentioned above, at the beginning the block reward was 50BTC.

The first halving happened in November 2011 and the block reward became 25BTC.

The second halving happened in July 2016 and the block reward became 12.5BTC.

The third halving will happen in May 2020 and the block reward will become 6.25BTC.

This process will continue in the future until all 21 million bitcoins are mined.

It’s off topic, but a novice may have thought of a question such as: if someone doesn’t like it, can’t he just change the code?

And the answer is: he can. But the result won’t be Bitcoin and what he’ll own won’t be supported by the Bitcoin network.

Okay, let’s keep it at that for now.

So just park the idea, put it aside, and we’ll bring it back in shortly.

Now, let’s switch to the investor role – looking at some historical data for Bitcoin’s price.

Bitcoin Cycles

Let’s first look at some history of Bitcoin’s boom and bust cycles.

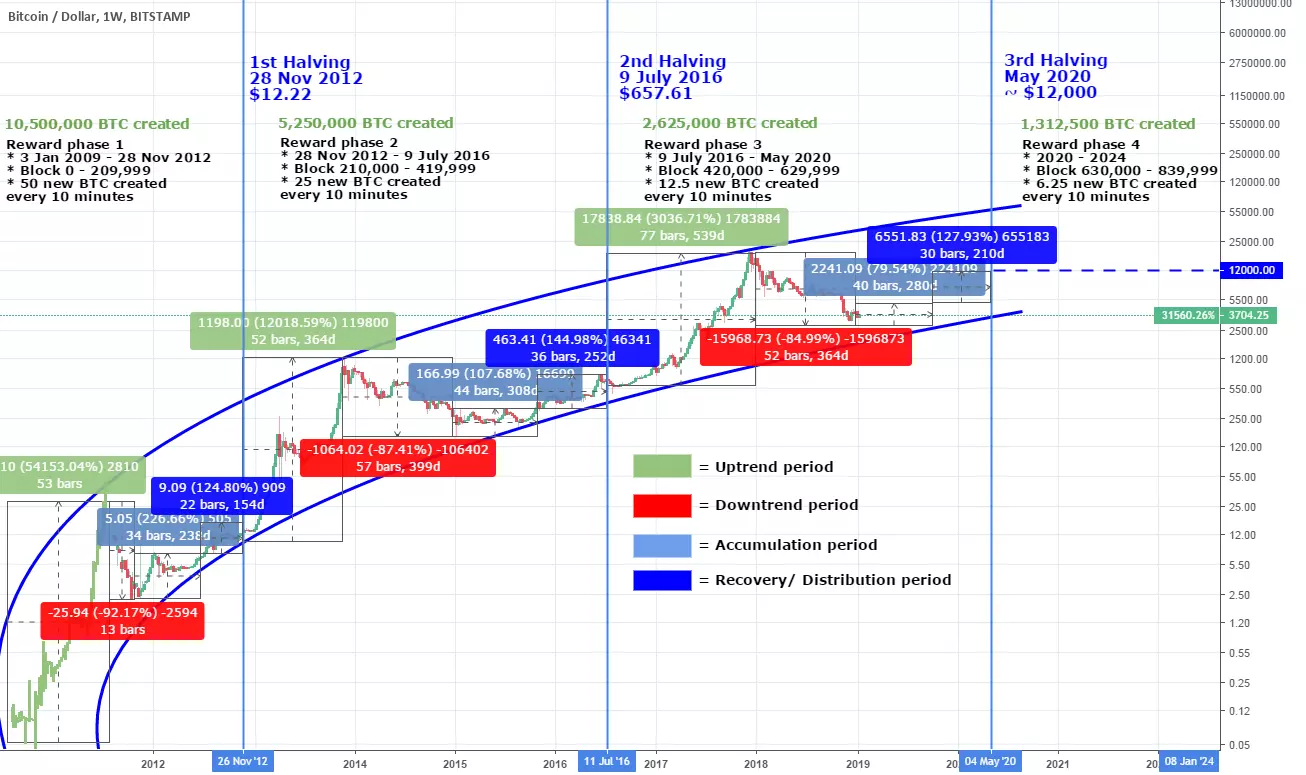

Here’s a chart containing both linear and logarithmic scales, as the early booms and busts are invisible in comparison to the 2017 rally.

To zoom in a bit for a better visual representation, here’s a chart of Bitcoin’s price until end of 2015.

And here’s a chart of its price since end of 2015.

The bubbles are visible, but let’s see them relative to each block reward halving over time.

Take a really close look at the next picture. The vertical lines represent the halving events.

Source

Okay, what do we observe?

First thing I want you to see that during the halving events, not much happens.

But then, we have the switch from “accumulation” to “recovery” phase leading to both the high to ~1000$ before a long bear market and the recent (all time) high to ~20000$ before another long bear market.

But I won’t leave it at “the history does not repeat itself, but it rhymes“.

Let’s see why this happened in the past and why I expect it to happen again.

The Halving’s Effect on Bitcoin’s Price

First thing first, please recognize that we’re not discussing day trading here.

The day to day volatility is irrelevant to me. I’m more focused on the big picture, the macro trends. More comfortable allocating money for the mid-to-long-term in any market. Bitcoin’s price may crash or increase 20% tomorrow and that won’t change my expectations.

With that said, let’s go back to the topic. So, we don’t see any price action during the halving events.

However, what a halving event is is a supply shock for the Bitcoin market.

An analogy would be the following. Story time.

Imagine you worked for the past few years and saved aggressively, building a solid savings of around $100k.

All of a sudden, the government decides that every salary will be cut in half and enforces this rule from tomorrow.

That means that people won’t be able to afford what they did, so they’ll be forced to be more reasonable with their spending and allocate it to bare necessities. Since their monthly budget is now 50% of what it was, as consumers, they become really upset.

Producers aren’t able to sell with these high prices, so they get upset as well… So much stock waiting to be sold, but nobody’s buying. However, due to this new regulation, both the production costs and wages are now lower, so they can afford lowering the price of all products. And if they do, they can earn the same margin and the consumers can spend again.

So producers lower the prices for all goods up to 50% so it’s aligned with the 50% pay-cut of every consumer. Short crisis but the standard of living is virtually the same. Everyone’s happy again.

This is all controlled by the law of supply and demand and it’s a guarantee that it will self correct, stabilize, and end up in equilibrium – determining the price and quantity exchanged for which the benefit to society is maximized.

Okay, interesting story, but what does it mean for you? Well, your salary again has the same purchasing power as previously, as everything just got cut in half.

But what about your savings?

Well, nobody took half of your savings away.

You were responsible and saved, and now your $100k can buy twice the amount of goods they could buy previously.

Your wealth doubled. Enjoy.

This analogy maybe can’t be mapped one-to-one to our scenario, but does a great job of explaining how a limited supply affects the value of an asset.

In other terms, decreasing the money supply is deflationary – it increases the purchasing power of the money.

Of course, all of this is hypothetical because FIAT currencies are inflationary – their supply is increasing and they lose purchasing power over time.

But the scenario we described will happen with Bitcoin.

The ongoing supply will be cut in half.

And it’s simply supply and demand from there.

Supply & Demand and Human Emotions?

Isn’t the price driven by human emotions such as fear, greed, and the like?

They’ll all be here.

But they’re not the leading factors to massive price movements.

However, they add liquidity to the market.

They enhance a bull run.

They deepen a bear market.

They’re the exact reason why the price increase doesn’t only double to satisfy the supply which is lowered by 50%, but skyrockets in multiples of 10 each time this happens.

They’re part of the demand.

But not exclusively.

Bitcoin is currently getting increasing media attention. It may still not be as popular as in late 2017 but goes through a slow and steady process of adoption. I don’t want to go into too many details about the long-term future of the cryptocurrencies as that deserves a post itself, but at this moment neither the traders, hodlers, nor the general population is losing interest in Bitcoin any time soon. And the bull run (that already started), will just make it even more desirable, at least in the short-term. Let’s also not forget that scarcity increases demand.

So, with all that said, I’d say we’re comfortable assuming that the demand for Bitcoin won’t decrease in the near term, and the same time the supply will halve. This will leave the market forces to set the price to where it makes sense for all market participants.

This is regulated by the market itself and will happen regardless of what any government decides about it, how is it taxed, whether someone writes something on Twitter, or whether the humans feel FOMO, FUD, greed, panic, or are happy or sad.

This is supply and demand – and that’s the greatest force behind all crypto bull markets to this day.

At the end, miners need incentive to support the network. And if this incentive gets cut in half, only a price increase can make it to be profitable again.

And if it’s not, Bitcoin will fail. It’ll be all over. Trading alone won’t be able to support any price level and it will become a thing of the past.

Not because it can’t go on using the current supply, but because miners losing interest will allow people with cruel intentions to get control over the network and reach consensus for illegitimate transactions. They’ll be the majority and thus able to confirm any transaction they want.

This is a likely scenario if people lose interest in Bitcoin. And if they don’t, Bitcoin to teh m00n is guaranteed – it’s basic economics.

Bitcoin Price Forecast

Okay, what about the number, right? That’s what everyone wants to see.

But let’s be realistic, it’s a fact that nobody can predict the top.

And it doesn’t matter.

Because if someone aims for the top, he’ll either sell early missing on a massive price increase or won’t even reach the price to sell.

What does matter is that we’ll see a major price increase during the next year or two after the halving.

Anyway, seeing the current price action, I anticipate a price close to the ATH in mid 2020 followed by a steady growth in the second half of the year, and finishing in a rally / bubble during the gold rush at early / mid 2021, as the effects of the supply shock start shaking the world.

And the new ATH – it can either be a multiple of 3 or 10, external factors can push it or suppress it. However, I do think that Bitcoin reaching a six digit number in USD is possible.

What if I’m wrong?

Nothing.

I’ll lose some money and you won’t, as I didn’t advice you to invest.

Have in mind that I’m a big supporter of decentralization and freedom in general, so I have reasons beyond profitable trades to be in the market.

I’m also a miner and gladly support a system that incentivizes me to do so, while at the same time sadly support another system that forces me to do so.

What if I’m right?

Then we have a different kind of problem…

When to sell?

What’s my price target?

Well…

As mentioned, I think breaking $100k is definitely possible.

Many people would add “but unlikely”. I don’t think it’s unlikely, but I think it’s too risky to wait with the full position to sell at $100k or above. That’s why I have multiple price targets.

For example, I’ll sell 5% of my position close to the current ATH. I’ll sell 10% at $30k. I’ll sell another 10% at $40k, etc.

These are not yet definitive numbers, but just an illustration of my approach.

There will always be something left to ride the full wave and I’ll have absolutely no regrets about the gains missed.

I’ll be more than happy to do one last sell after the bubble bursts, as even a 30% pullback we’ll see from the new all-time-high will be much higher than where we currently are.

And the best part?

It will be a bubble. The media attention and various human emotions will make the price unsustainable.

Bitcoin’s price will go down 60-80% allowing people like me to reenter the market.

And if you miss it or if you’re on the fence, this is good news for you as well.

You can keep this post in mind for 2024. I’m not saying “invest” or giving any type of financial advice, but just keep it in mind.

Because this is exactly what’s going to happen:

- Bull run – already started

- ATH – year to year and a half after the halving

- 60-80% crash

- 2-2.5 years of bear market

- Repeat.

After some time, it becomes obvious.

Follow macro trends and enjoy the ride. 🚀

Closing Thoughts

As most of my readers know, I support and invest in various cryptocurrencies.

I wrote about this exact topic during the breakout of the bear market and the strategy is still consistent on the verge of the bull. If you still haven’t, read the post How I Invest – my expectations didn’t change much since then.

Crypto used to be only a 5% part of my portfolio, but after some accumulation and massive gains during this year it grew to around 15%. I’m still comfortable with that allocation but consider it risky enough to go all in with the rest of my wealth.

My crypto portfolio, internally, is not composed only of Bitcoin, although it has the highest allocation currently.

I also hold various other cryptocurrencies, such as: Ethereum, Litecoin, Ripple, Bitcoin Cash, Tezos, Cosmos, 0x, Stellar Lumens, EOS, ZCash, etc.

I experienced and expect massive gains in these as well. Not surpassing the market cap of Bitcoin (in USD), but achieving higher multiples.

Similar as stocks, the crypto market has cycles. And when we’re in a bubble, they all go up.

Then they all pop.

And the one that survive are candidates for the next bull run.

Patience is the name of the game.

Financial Advice

Let me wrap it up with some financial advice:

Don’t invest in anything solely because of reading this blog.

Apart from the sentence above, absolutely nothing you read here is financial advice.

I just wrote my expectations about the future and I’m most probably wrong.

No Comments