Category: Finance

Your Role in the Next Big Thing

“If I only have started investing in 2009…” Has a thought like this one ever crossed your mind? I’m sure it has – as is the case with any person on the lookout for a “next big thing”. But of course, over time you increased your knowledge, developed skin in the game, and earned the …

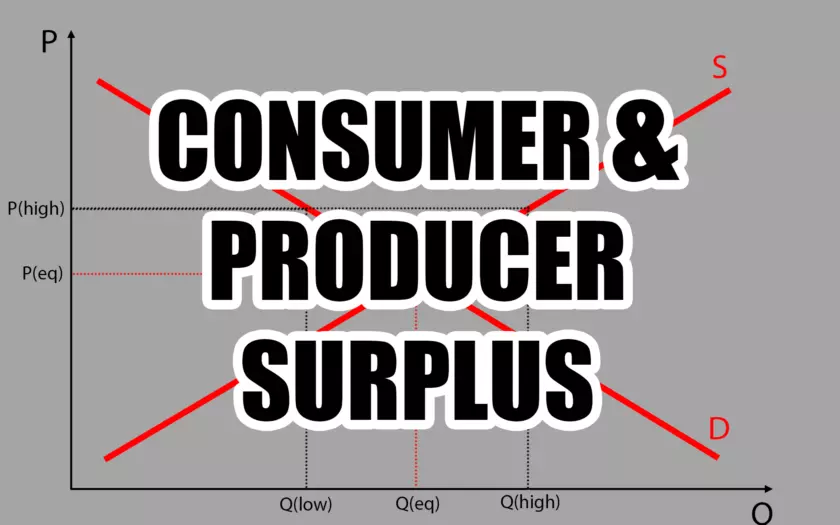

Consumer and Producer Surplus & Deadweight Loss

This is the second post of a 3 part series on Supply and Demand: Supply and Demand – An Introduction Consumer and Producer Surplus & Deadweight Loss (current post) Obstacles to Efficiency – Taxes, Price Controls, Trade Restrictions Welcome to the second post of the Supply and Demand Series. In the first post, Supply and Demand – …

Supply and Demand – An Introduction

This is the first post of a 3 part series on Supply and Demand: Supply and Demand – An Introduction (current post) Consumer and Producer Surplus & Deadweight Loss Obstacles to Efficiency – Taxes, Price Controls, Trade Restrictions The law of supply and demand is something that’s often referenced, but rarely explained. And most people without formal education …

Should You Lend Money?

Yes. Both bonds and P2P lending are great ways of diversifying across asset classes and get a good ROI… Oh wait… That’s not the topic? I see, wrong title! Let me fix it right away. Should you lend money to acquaintances, friends, and family? Instead of rushing to the conclusion (of saying “no”), let me …

Taxation is Immoral and Borderline Slavery

Some time ago I wrote a post explaining what taxation is and covering a few of the most relevant taxes for my readers. What I didn’t do there is express my personal opinion about taxes. And I’m pretty opinionated on the topic. If you earn your income legally or invest, we most probably share the …

Taxes for Dummies – How Tax Works?

The (target) audience of MonkWealth mostly consists of people enthusiastic about personal finance and investing. Wherever you are, if you’re accumulating wealth, eventually the topic of taxes will be a recurring and potentially quite frustrating part of your life. Especially when you’re yet to understand how they work. And indeed, what I observed is that …

Recession Prediction and the Media (September 2019)

After I spent August without checking my stock portfolio at all, September felt great. At least in the first half of the month, where the short-term trend seemed positive. Positive but irrelevant – long run investors are not in it for quick profits. Anyway, here’s a chart of the S&P 500 during September. But is …

Index Funds or ETFs – What to Pick and Why?

Many beginner investors struggle with the dilemma of building a portfolio using index funds or ETFs. I will assume that you know what what they are and how they work, because the idea of this post is to help you decide which one to use for your portfolio. And of course, we will look at …

Opportunity Cost With a Twist

Opportunity Cost is the cost associated with foregone opportunities. Most of the time when we make a decision, we usually pick one of multiple mutually exclusive options. Although many people consider the risks and returns of the chosen option, many also neglect the potential returns of the alternatives. And it makes sense, as a person is not …

Inflation Explained

Before I was living in The Netherlands and before I knew about FIRE, a friend of mine opened an interesting discussion. He said that he was thinking about how much money a person needs in order to not depend on a salary. I was intrigued. In our country, he said, a person can live comfortably on …