As this was a pretty busy month for me, I wrote the monthly update post in advance to have it ready for October 31st. It started with the following sentence:

This month was not the most exciting in terms of events or financial news, so I decided to share some stuff I find interesting.

Well, the month took a turn in the last week.

So, no references to “some stuff I find interesting”, folks. Let’s dive into what’s going on with the markets and, more specifically, my portfolio.

And yes, you will have the chance to Earn a Small Amount of Risk Free Money. Keep reading!

Cryptocurrency

The post I wrote and eventually discarded… It also contained the following sentence.

My cryptocurrency portfolio took a strong hit at the end of September as BTC plummeted at the end of last month, but I was unfazed.

Indeed.

And it was hovering sideways throughout October, until the surge on 25th, reaching more than a 30% jump within a day.

While we’re at it, check out the time of filling my buy order:

Could’ve it been timed better? 🙂

Don’t get me wrong, it can certainly be a bear case in the short run, there is no Dunning-Kruger kicking in here. I’m aware that anything can happen in this market and accepting the higher risk for the higher reward.

However, I do think that it’s going to teh m00n in late 2020 and thus hodl. History, supply and demand, the ongoing adoption, and FOMO all support my forecast. None of them conveys certainty, but believing in the technology helps to enjoy, instead of fear, the volatility.

I’m really really comfortable on this roller-coaster. 🚀

I touched upon this topic some more in my How I Invest post, so take a look there if you still haven’t. You’ll like it.

While we’re at it, if you’d also like to invest in the crypto markets, open an account on Coinbase by clicking this link. You can also read my review and instructions here.

If you’d prefer a referral link, so we can both get 10$ worth of Bitcoin in our accounts once you buy 100$ or more of digital currency, drop me a message.

Now, about that small amount of risk free money…

Free money

If you open an account on Coinbase, through my referral link or not, you’ll have the chance to participate in the Coinbase Earn program after verification.

Coinbase Earn has a few short courses (consisting of 4-5 2 minutes videos) teaching you about a certain digital currency and granting you money for answering a question about the videos. These questions are not hard and are related to what you just watched.

There is no catch.

Once you have an account and are verified, you can literally answer a few questions and earn up to 136$ (or up to 42$ without inviting other people).

If you’re already a verified Coinbase user, I’d appreciate if you went on Coinbase Earn through the following links:

- Link for earning at least 10$ worth of Stellar Lumens (XLM)

- Link for earning at least 10$ worth of EOS

But if you don’t have an account yet, just register with the link above and check out Coinbase Earn after you’re eligible.

The current coins that you can earn are: DAI (up to 20$), XLM (up to 50$), EOS (up to 50$), 3$ of ZEC, 10$ of BAT, and 3$ of ZRX.

P2P

It’s been a while since I contributed to my P2P portfolio.

This month I went back to it, as I decided to rebalance it a bit and diversify into higher yielding platforms.

Although I don’t see P2P as the riskiest of all investments, I still consider it a bit risky, but I don’t think that this risk is related to investing on certain platforms but to P2P lending itself. So while assuming a certain degree of risk, there is no reason not to chase higher yielding platforms and projects and thus diversifying a bit more.

Check the Things I Use page to see all the platforms I use.

Stocks

Damn! 🙂

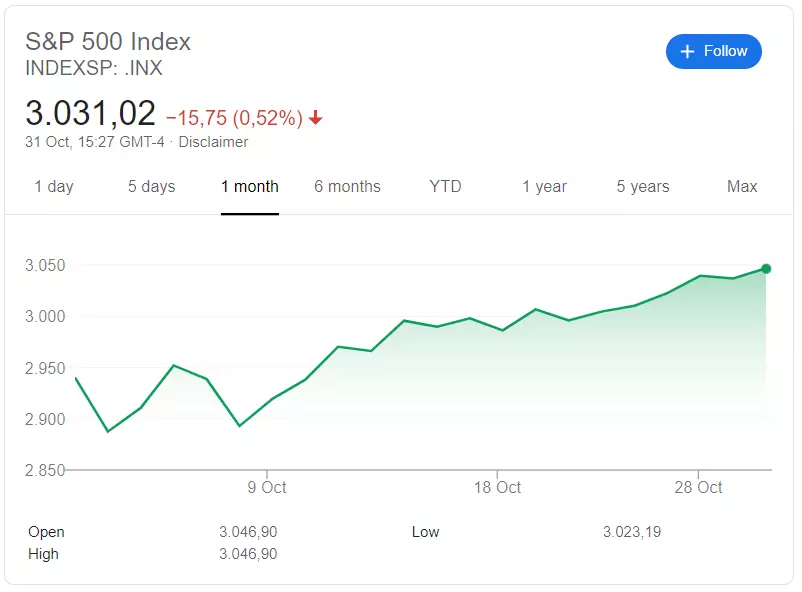

It was a pretty quiet month at the beginning, but ended with the S&P hitting a new all time high. This itself was enough of a reason to discard the post I’ve prepared for this monthly update and write about the stock market instead.

So here it is, the most recent ATH at the time of writing this post.

… Not like we’re selling anything, but anyway.

In terms of taking more risks… Recently I also added emerging markets to my portfolio, but only a small portion of 5%. My portfolio indeed bears some risk, but there is also a fat pile of cash sitting on the side to balance everything out.

If you know about a reliable institution offering savings accounts that yield more than 1%, let me know in the comments. I’d love to decelerate the rate with which my money lose value without tying them to a fixed-term deposit.

Other news

MonkWealth turned one this month.

Happy birthday.

PayPal.me/MonkWealth

PayPal.me/MonkWealth