How the Money Printer Makes You Poor

You might have seen the “Money Printer” meme. It’s been all around the internet since the last economic crisis.

In case you’re not sure to what extent the money printer impacts your life, you’re at the right place.

Before we begin, I’d recommend giving this terrifying 2 minute video a watch. This is Christine Lagarde, the president of the European Central Bank.

(No obligations, you can do it later as well)

When asked about the balance sheet, her evasive demeanor and tone of voice speak louder than her words: “We have no plan”.

But if you have the ability to see these things and remain indifferent, you most probably need a lesson on quantitative easing.

Quantitative Easing

Simply put, quantitative easing is a monetary policy implemented by the central bank in order to stimulate the economy.

Sounds innocent so far.

This is done by injecting money in the economy… Money that previously didn’t exist.

TLDR: Quantitative Easing is printing money.

The Money Printer and Your Quality of Life

Since you’re born, you’re a part of a system that creates artificial demand for FIAT money.

FIAT money is not something we value by ourselves. It doesn’t exist in nature. If someone insist to pay you in Bahraini dinar banknotes, you’d most probably refuse to trade with them. At the same time, it may be the most valuable thing to that person. How so?

Well you’re the same – when you’re within the borders of a certain framework (such as a country or economic union), you’re trained to value its FIAT money.

Everyone uses it, everyone gets paid in it, the government requires its taxes in it.

You’re taught to work hard for it, sometimes even offering the majority of your life and morals in exchange. You grow up to exercise greed exclusively in the context of “wanting more money”. Rich people fight you for it, poor people hate you for it.

Everything for a number in a database.

And after you spend a decades breaking your back to enjoy a certain standard of living, your overlords decide to double the money in circulation.

Why Should This Concern You?

All of a sudden, there are twice as much money to buy the same amount of goods and services that existed before. What this means is that your piece of the pie just became two times smaller.

All of a sudden, you can afford half the house, half the bread, half the necessities compared to before.

This is exactly the framework we’re living in – our purchase power halves every decade or so.

But don’t take my word for it.

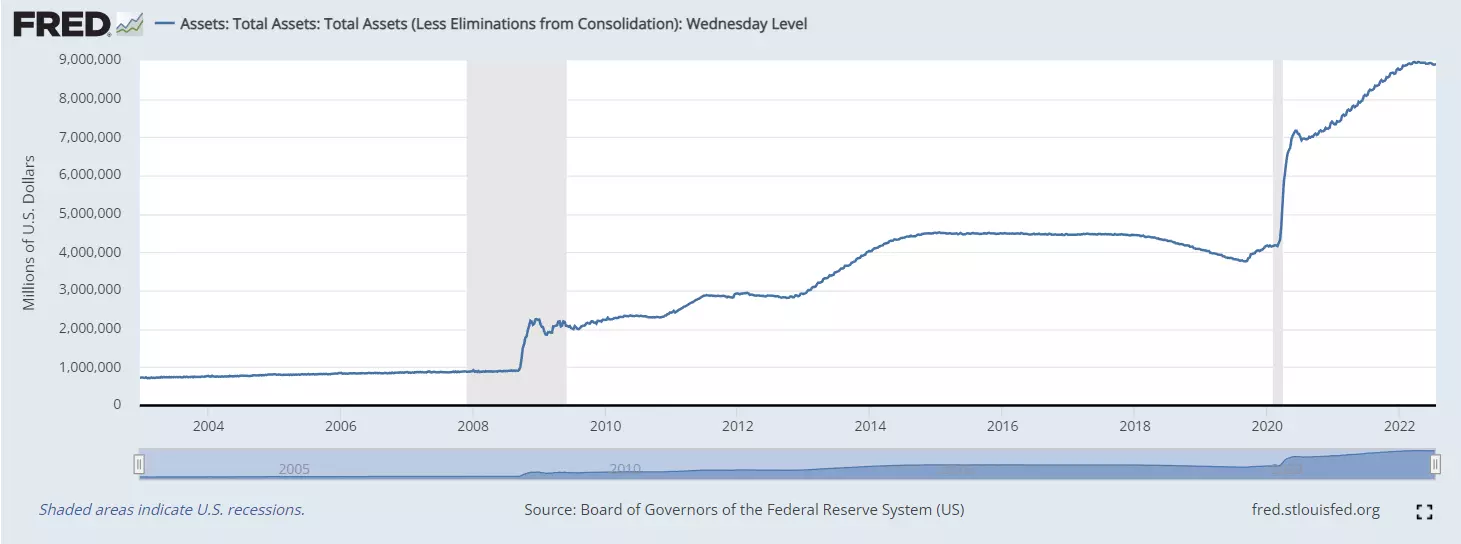

Here’s the balance sheet of the Federal Reserve over the past two decades:

Source

As you can see, money appear out of nowhere around recessionary periods. Almost like alchemy. Coincidentally, shortly after the fact, people feel how their purchasing power quickly erodes.

But nothing got more expensive.

The money they had became cheaper.

It’s a simple function of supply and demand – the amount of things available for buying remained the same, the supply of money doubled.

The only reason most people don’t see it as a devaluation of the currency but an increase in prices is because their whole lives they were taught to use the currency of their country as a reference point. And everyone ends up talking about housing becoming more expensive, wages being stagnant, etc.

But these are all consequences of inflation. Not causes.

And the cause is is simple:

Central banks printing money.

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output

- Milton Friedman

The Solution?

Having a limited-supply asset as a reserve currency would make sure that nobody can create more of it. But nobody’s going back to the gold standard – the global economy is addicted to free money once times get rough.

[QE] has drawn political criticism but has become an increasingly common response to economic and credit crises, used effectively by the European Central Bank and the Bank of Japan alongside the Fed.

- Investopedia

The only thing you can do as an individual is to focus on wealth preservation. The most intuitive approach to do this is by investing in the stock market. This way, you’d be buying assets whose prices increase with inflation, same as the prices of everything else.

But even then, you might preserve your purchasing power but you’re still part of the system. You’re still a victim of a corrupt, rotten framework that brainwashes the society into greed, selfishness, and sometimes even violence.

And when you understand this vicious cycle, you develop laser eyes and see the big picture…

And the solution becomes clear:

Buy Bitcoin.

No Comments