I Invested $50k in Bitcoin and Ethereum

On 25th of June 2022, I bought >$50k worth of cryptocurrency – Bitcoin and Ethereum.

First thing first, for full transparency:

>€37k in BTC and >€12k in ETH, for a total of >€49k, or at the 25/06 EUR/USD rate, >$52k

Note: This is not my first entry into crypto nor my total crypto position.

I’ve been a HODLer for a while and it changed my life over the past few years. This post is only dedicated to the purchase of Bitcoin and Ethereum I did on 25th of June 2022.

Table of Contents

The Decision

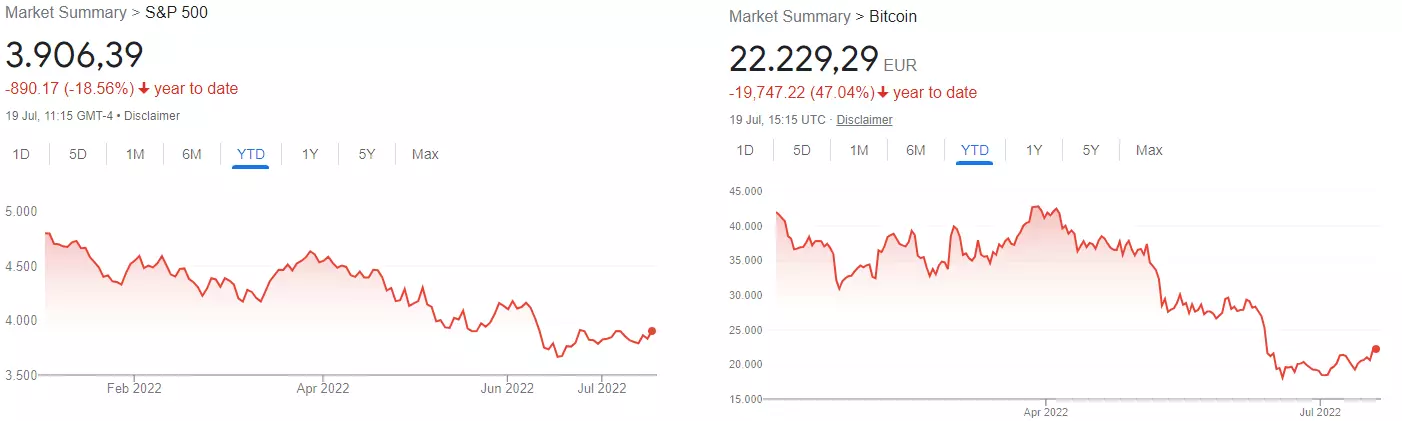

Today it is July 20th 2022 and we’re in the depths of a bear market, both in stocks and crypto.

Year-to-date performance of S&P 500 (left) and Bitcoin (right) in July 2022

So, given that I’m getting a much better price for assets I like to own more of anyway, I started increasing my DCA amounts for stocks, and started continued buying crypto for the first time since the start of the bull market in late 2020.

But my motivation for an extra lump-sum came while I was reviewing the amount of cash I was sitting on during 2020. In all fairness, I actually did invest aggressively during the 2020 recession, but I still had around $80k of unutilized capital, generating opportunity cost.

Why though?

My mind was still under the influence of the “FIRE movement“, obsessed with excessive “emergency funds“, “frugality“, “fearing the worst“, etc.

If you’re a personal finance enthusiast, I’d suggest not following these principles blindly… They’re great, but you need a personal twist to your story.

Anyway, lesson learned and my bank account looks much different now. I’m investing over 80% of my net income anyway, so being “tight on money” is not a realistic concern for my situation.

It’s never been!

And I recommend you to think about this if you’re hoarding money while living in a society where paycheck-to-paycheck is the norm. “Who’s the sucker?” is the question you should be asking yourself.

Any extra capital should be put to work because inflation will corrode it sooner than you expect.

Inflation-Hedge Status?

Some may ask “how does X beat inflation when it dumped Y% in the past Z months?”

I’ve been asked similar questions and there is no “one answer fits all”. So here are 3 perspectives you can choose from:

Answer 1: the Trader Perspective

If you 1) considered investing in something before, 2) it fell in price, and 3) its fundamentals didn’t change, what exactly happened that you’re avoiding it now?

It dumped X%, right? Doesn’t that make it a fire-sale? 🤔

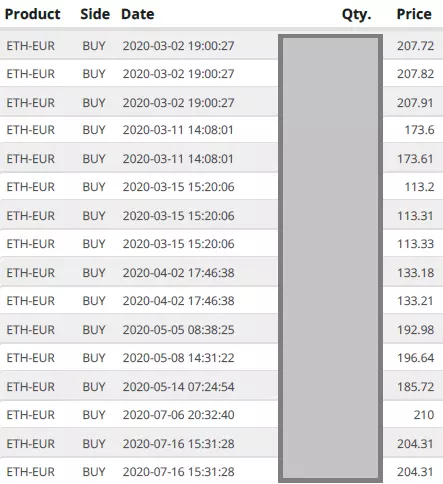

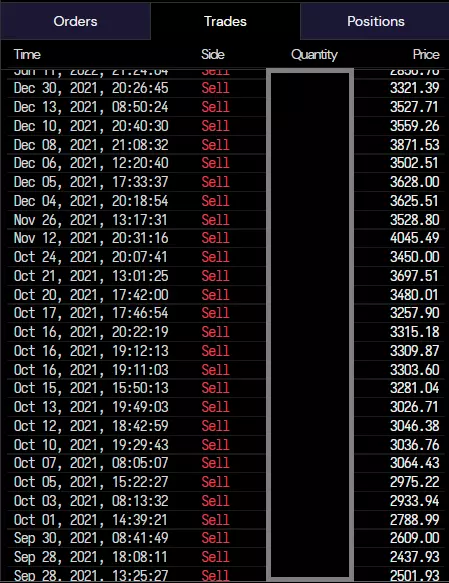

This is not my first crypto winter, so I’ll let a picture illustrate 1000 words. Here are some of my Ethereum BUY transactions during the crash of 2020. Pay attention to the Price column:

And here are some transactions from the SELL side during the all-time-highs of 2021, because I’m a genius. Again, pay attention to the Price column:

More than 15x return – not a bad ROI for a year or two. No surprises what fueled the fast track to my FIRE Target, right?

“But past performance is not a guarantee for future returns!” – Point missed. I’m showing the trader perspective – the concept of getting discount deals on things that you, not me, expect to grow in price.

Answer 2: the Investor Perspective

Zoom out.

As a buyer of BTC since 2017, I learned the importance of acquiring assets I find valuable regardless of price and letting time take care of the rest.

Answer 3: My Actual Opinion

The price is irrelevant.

Think about the asset you’re comparing it against.

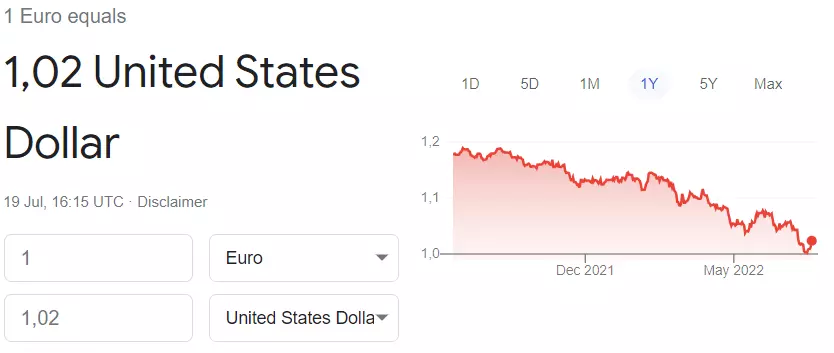

The EUR fell almost 20% in the same time against the USD.

And the USD buys much less goods and services than previously.

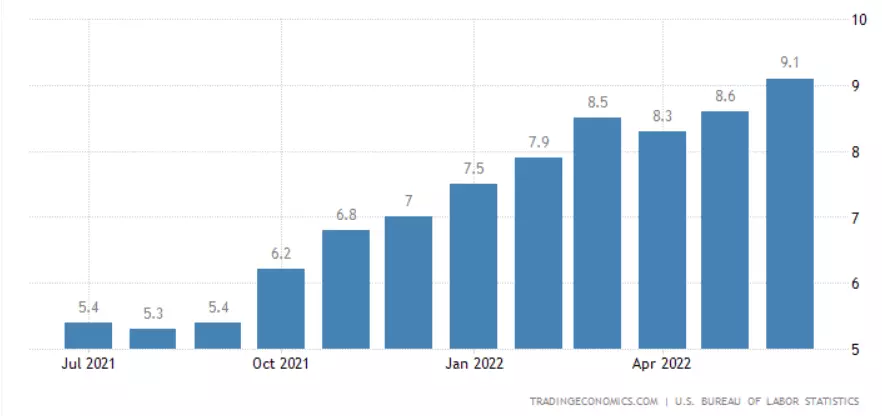

The US inflation rate for July 2022 is 9.1%:

One crucial difference between those and Bitcoin is that everyone knows exactly how much Bitcoin there will be in circulation at any point in time.

Remember: inflation is exclusively created by increase in the money supply.

Don’t take my word for it:

To wrap up, if you’re comparing two volatile assets against each other, you can’t really speak about the objective performance of any. So pick what you prefer to own.

I made my decision.

What’s Next?

Well, I’m generally not a trader, especially not with Bitcoin. I mostly buy assets I like owning rather than generating worthless money with.

Bitcoin can/will go lower in the next months and/or years. It will certainly be volatile. That doesn’t affect me – similar to how a decline in stocks’ prices shouldn’t affect an investor’s DCA strategy.

Even if I’d enter the trader role, this is not a short-term play. At this moment, I’m up around 20% on my $50k investment in less than a month and I’m not considering selling. I actually expect the next level of magnitude in terms of price to be in 2025, a few months after the next block reward halving of Bitcoin.

But!

Again… This is just the price… And I only address it is because many readers might be interested in it.

For me, Bitcoin is a revolution and represents freedom. If you self-custody (you should!), you’re taking advantage of the first opportunity in human history to own something without the need to trust anyone.1

That’s a revolutionary concept and everyone will wake up to the idea that decoupling money from state is a major step forward for humanity.

Just my 2 cents.

Comments: 2

Welcome back! 🙂

Great read!

It looks like you have to trust your broker though 😉

Thanks!

Never. Brokers are the interface with the FIAT world. Beyond that, self-custody is the norm – I recommend using a hardware wallet rather than the alternatives.