Rebalancing – Managing Your Investment Portfolio

Rebalancing means redistributing your wealth across different investments, in order to match your target allocation.

Understanding asset allocation is crucial in order to understand the need for rebalancing. So if you still haven’t, make sure to read this post: Asset Allocation.

Table of Contents

Rebalancing Explained

Rebalancing usually happens on frequent intervals or when the asset allocation drastically shifts.

An investor’s allocation can shift due to an asset overperforming the rest of the portfolio, or a certain investment lagging behind. Whatever the case is, this leaves the investor with a wealth distribution different than the one he had planned upfront.

This is not always an issue, but the reality is that now he finds himself more exposed to an asset/asset class than what he aimed for before.

So the right thing to do here is to rebalance – sell some of the winners and buy some of the losers in order to bring back the portfolio to its initial, target allocation.

A specific example will explain this concept better than theory:

Rebalancing Example

Let’s say you have $200,000 invested in a portfolio of two ETFs, with an allocation of 50/50.

This means that you have $100k in one ETF and $100k in the other.

Over the next year, one of your ETFs has a great performance and rises 40% in price. The other one had a not-so-well performance and lost 10%.

This means that you now have $140k in the first ETF and $90k in the other.

Of course, this is great – your portfolio grew to a total of $230k. But now your asset allocation is not 50/50 anymore. It’s closer to 60/40.

This means that your exposure to the first ETF is now higher. In other words: not in line with your target asset allocation.

In order to balance it out, you’ll need to do some buying and selling. Distributing $230k based on the target allocation means having $115k in each.

So you sell $25k worth of the first ETF to bring it down to $115k. And buy $25k worth of the second ETF to bring it up to $115k.

Congratulations, you successfully rebalanced your portfolio back to your target allocation of 50/50.

Biggest Benefit?

The biggest benefit of rebalancing is that it forces investors to sell high and buy low.

This is actually what everyone’s supposed to do, but those without a strategy usually end up doing the opposite.

Think about it, the assets that had a better performance and grew in value now become a larger part of your portfolio. In order to bring their allocation back to your initial plan, you’ll have to realize profit.

You end up selling some of the winners to buy some of the losers.

What if you don’t want to sell?

I hate selling as well… And I got you!

At the bottom of the post, I’ll give an alternative rebalancing strategy that can work just as well as what I just described.

Keep reading about the basics so we don’t get too side-tracked.

When to Rebalance?

Prices move every second.

Of course, rebalancing that frequently/daily would significantly increase the complexity of what supposed to be a “passive portfolio”. You don’t want to do that.

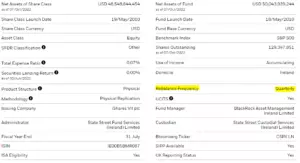

Even index funds and index-tracking ETFs rebalance their holdings quarterly. You can see this in their factsheets. For example, a screenshot from the iShares page for CSPX:

So, what should you do?

As an index investor, once per year or semi-annually is more than enough. If you’re comfortable with some more activity every quarter, you can go for quarterly as well. But annually is the go-to frequency for most long-term investors.

And remember, it doesn’t necessarily have to be towards the end of the year. Just pick a day and do your rebalancing on the same date every year – maybe the date of your first order.

Of course, your monthly contributions remain based on your predetermined asset allocation, and on your rebalancing day, you just do the necessary transactions do balance it out.

This is the most effort you will put into maintaining your portfolio… Unless you are diversified enough using a single ETF portfolio, in which case you don’t have to do anything.

Alternative Rebalancing Strategy

As promised, I’ll end this post with my favorite way to rebalance.

Most of us hate selling assets. This is either due to unnecessarily inviting tax bureaucracy or ideological constraints.

Thus in my opinion, it’s better and simpler to just buy more of what’s lagging with your next deposit(s) instead of combining buy and sell trades.

Whichever way you choose to do it, the goal is to achieve the original proportion.

No-sell Rebalancing Example

Let’s say you have a portfolio to which you contribute $5,000 every month.

Your asset allocation is simple: 80% in a US ETF and 20% in a EU ETF.

Since your last rebalancing, your portfolio grew to $100k. During the same time, the US markets performed a bit better than the EU markets, so your allocation shifted.

Now, instead of having a $80k and $20k respectively, you ended up with $84k and $16k.

On your rebalancing date, you’ll use your monthly contribution to balance it out.

So instead of distributing your $5,000 as usual (80/20 – $4,000 in the US ETF and $1,000 in the EU ETF), you’ll change it up a bit.

You’ll calculate how much you need to buy of the ETF that’s lagging in order to bring your allocation back to 80/20.

In this case, you put your $5,000 in EU, ending up with a distribution of $84k and $21k, which is exactly 80/20 of a $105k portfolio.

Congratulations, you didn’t have to sell your precious long-term assets.

Note: as your portfolio grows, a single contribution might not be enough to balance it out. If you’re firm on not-selling, you can either increase your rebalancing frequency or achieve the target allocation over the next few contributions.

Closing Thoughts

Remember, your asset allocation is one of the most important factors on how your investment experience will be.

That’s why it’s extremely important to know how to balance out your long-term investments once they shift.

This post is Part 10 of the How to Start Investing Series.

- Previous post: Lump-Sum Investment – Time in the Market Done Right

- Next post: Why the Stock Market Always Goes Up? (Your Safest Investment)

No Comments