Why the Stock Market Always Goes Up? (Your Safest Investment)

In my blog, and probably many others, you see “the stock market” being portrayed as a “safe long-term” investment. A place where people put their hard-earned money and assume life-long gains.

How is everyone so sure that the stock market will go up?

I’ve been an investor for many years and enjoyed massive gains from various types of investments. The only way to achieve this is to have a 100% conviction in the process. Because only then, you’d allow yourself to invest a large portion of your savings/productivity and knowing, with full certainty, that you’ll be well off in the future.

If you fail to do this, you’ll only see stocks as some “risky bet” or something you “trade”. Not as “investments”.

If you’re hyped to achieve this shift, enjoy – this is your beginner’s introduction to: “Time in the market beats timing the market.”

The Stock Market: Historical Performance

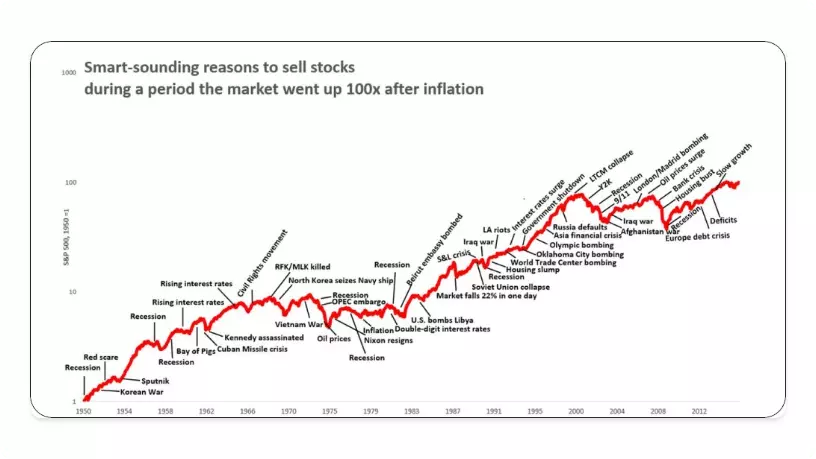

Let me start by showing you a nice picture I found.

This is a chart of the S&P 500 since 1950.

On the picture, you can see many labels pointing to periods where the world was collapsing.

But only by zooming out, you see that we turned out just fine.

Each time.

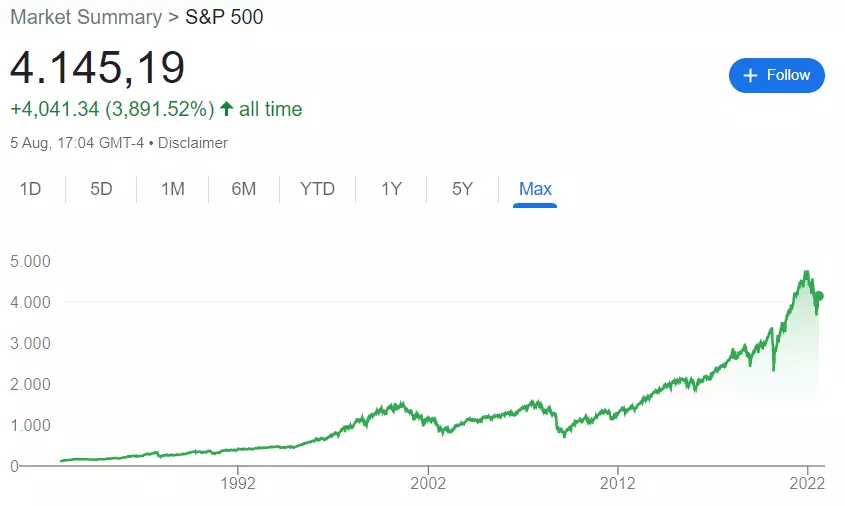

Actually, if you’d like a clearer representation of the 40 years of performance of the S&P 500, all you need to do is just google the term “sp500”:

The last few recessions don’t seem too extreme from this perspective.

This leads us to the long-term performance of the market:

Investment Returns of the S&P 500

In my post, Cash vs Stocks in 30 Years, I give a clear picture of the returns on the long-term stock market returns.

In summary, the S&P 500 grows at an average annual rate of 10% per year.1

That’s compounded over the decades. You know the quote about compounding, right?

Nevertheless, if you invested $100k 30 years ago and didn’t do anything since then, today you’d have $1,684,256. However, you’re not comfortable doing a big investment. You maybe want to invest a little bit each month, as you get paid.

Below are some of the results you’d get if you invested the same amount into an S&P 500 fund every month, regardless of price.

First, this is the 10 year timeframe (2012-2022):

- $500 per month is $60,000 invested. Today’s value is $132,535.32

- $1,000 per month is $120,000 invested. Today’s value is $265,070.65

- $5,000 per month is $600,000 invested. Today’s value is $1,325,353.23

And here are the results on a 30 year timeframe (1992-2022):

- $500 per month is $180,000 invested. Today’s value is $1,001,710.39

- $1,000 per month is $360000 invested. Today’s value is $2,003,420.78

- $5,000 per month is $1,800,000 invested. Today’s value is $10,017,103.9

All calculations are done using the DCA Calculator at DQYDJ.

Your take-away: investing $500 every month can make you a millionaire given the right time horizon.

Imagine how powerful you are if you can afford to invest a multiple of that.

And since you’re reading my blog, you most probably can.

Why Does the Stock Market Go Up?

Time to answer the million dollar question. Literally.

First and foremost, there’s the actual growth of all the underlying companies. This is caused by providing value to society through continuous increase in productivity technological progress.

Remember, as long as we’re advancing in productivity, technology, and innovation, economic growth is a guarantee.

This will be reflected in the prices of all assets, including stocks.

But there’s another factor: the devaluation of currency.

As humans, we’re used to measuring things in the currency of our country. When we can buy “less house” with our money, we think in terms of “the house prices increased”. But more often than not, the reality is “the currency’s price decreased”.

As such, we need to understand that inflation is part of life. It’s not going anywhere and it’s here to stay. Actually, in the economic framework we live, it’s a crucial part of its longevity. Literally, our financial system can’t work without inflation.

That’s why the central banks of all countries do all they can to stabilize it at a “healthy rate”. A rate which stimulates economic activity, but doesn’t harm consumers and producers by being too high. This target in usually 2-3%.

I won’t hijack this post to dive deep in the topic, but refer to the following post if you’d like to read more details: Inflation Explained.

So, TLDR: why does the stock market go up?

Because of economic growth and inflation.

The Last Concern

Okay, you believe in everything you’ve read and you agree with the ideas.

And it’s all great in theory, but now, you need to make the actual decision of deploying capital into the stock market. Yes, that’s your hard-earned money.

Your human nature won’t allow you to ignore the practical concern: what if it still collapses?

The Collapse of the Stock Market?

The stock market is the backbone of the world we live in. A total collapse of the stock market would mean a total collapse of capitalism and democracy.

If that happens, you can rest assured that losing a few United States Dollars would be the least of your concerns.

Understanding this concept is crucial in enabling you to develop the conviction you need. If you’re still concerned, you might like to diversify into decentralized assets as well.

But once you’re convinced, you’ll notice that the stock market isn’t “risky”. Investing in a specific company is risky.

The stock market is volatile. It goes through market cycles – crashes, recessions, and depressions…

Everything you need to do is handle the volatility.

Because regardless of the swings during the days, the trend is up over the years.

The only predictable way of growing one’s wealth is by matching the long-term economic progress of the world.

In my book, I have a full chapter covering all the phases the market goes through. It’s called Bulls, Bears, Market Cycles, and Recessions. I explain periods of economic contraction and expansion in more detail.

If you want all the information you’d need at one place, it’s a highly recommended read: Become an Investor.

The Stock Market and the Economic Machine

To understand how these market cycles form and how the government and the central bank treat them, watch Ray Dalio’s video called “How the Economic Machine Works”.

As a beginner, it may be the only one you need to understand the basics of macroeconomics.

I’ll end the post and leave you with it:

This post is Part 11 of the How to Start Investing Series.

- Previous post: Rebalancing – Managing Your Investment Portfolio

- Next post: coming soon

No Comments